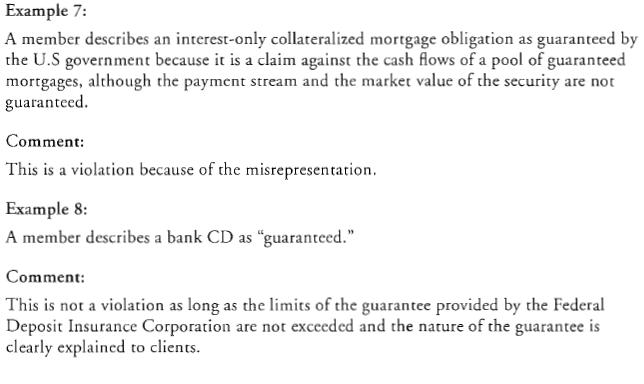

Example 7

从against the cash flows of a pool of guaranteed mortgages, although the payment stream and the market value of the security are not guraanteed.

上面这段不太理解,请大家指教一下。

Example 8

bank CD和Federal Deposit Insurance Corporation是什么关系?在网络上搜索了一些,也没有找到解释资料。弱弱的问CD市代表什么和FDIC的limits of the guarantee又是什么关系?

谢谢!

example 7, the I.O collateral mortgage is insured by U.S. governement, but the market price of such sercurity is still expose of interest rate risk

example 8, bank CD is issued by bank, and is insured by FDIC in case of default, and if default, FDIC only

pay a limit amount of fund back to investor by the term of "limit garanteed"

[此贴子已经被作者于2011-4-8 2:12:10编辑过]

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |