ffice" />

ffice" />

14. Fund A which pursues energy trading derivatives strategies is considering merging with Fund B, an equity derivatives trading operation. One of the primary drivers behind the merger talks is the possibility of savings on the technology and operations staff supporting each firm's trading environment. Certain of the facts underlying the merger discussions are as follows:

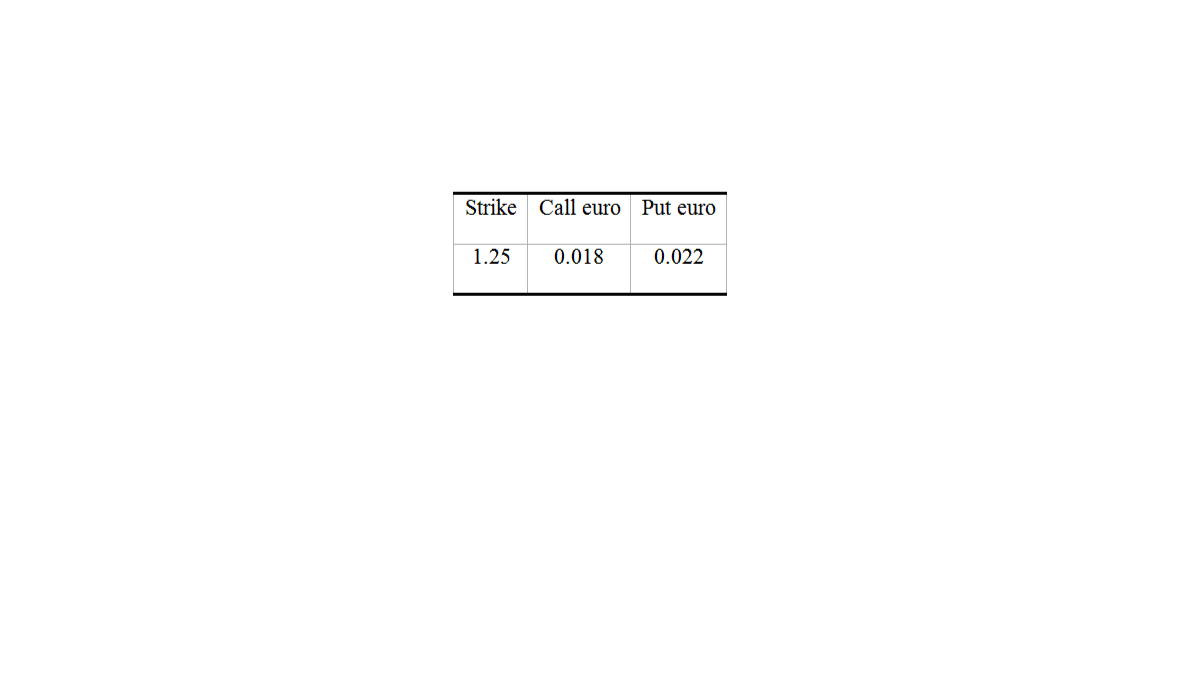

[attach]13798[/attach]

A. .52% due to diseconomies of scope

B. .25% due to economies of scale

C. .52% due to diseconomies of scale

D. .25% due to economies of scope

Correct answer is Dffice ffice" />

ffice" />

The answer is calculated as follows:

Economies of scope relates to cost savings generated by jointly using inputs for multiple products resulting in a savings. Economies of scale relates to the output of a single financial institution as it output increases its average cost of production falls.

Reference: Anthony Saunders and Marcia Million Cornett, Financial Institutions Management, 4th ed. (ffice:smarttags" />

谢谢

谢谢楼主

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |