标题: [2008]Topic 17: Trading Strategies Involving Options相关习题 [打印本页]

作者: Baran 时间: 2009-6-25 13:19 标题: [2008]Topic 17: Trading Strategies Involving Options相关习题

AIM 1: List why an investor would be motivated to initiate a covered call or a protective put strategy.

1、An investor owns a stock and believes that the stock’s price will remain relatively unchanged for the short term but is bullish in the long term. Which of the following strategies will be the best for this investor?

A) A covered call.

B) A protective put.

C) An at-the-money strip.

D) An at-the money strap.

作者: Baran 时间: 2009-6-25 13:20

The correct answer is A

A covered call strategy is used to generate cash on a stock position that is not expected to increase in value over the life of the option.

作者: Baran 时间: 2009-6-25 13:20

2、A covered call position is equivalent to:

A) a short put.

B) owning the stock and a long put.

C) a short call.

D) owning the stock and a long call.

作者: Baran 时间: 2009-6-25 13:21

The correct answer is A

The covered call: stock plus a short call, or a short put. The term covered means that the stock covers the inherent obligation assumed in writing the call. Why would you write a covered call? You feel the stock’s price will not go up any time soon, and you want to increase your income by collecting some call option premiums. To add some insurance that the stock won’t get called away, the call writer can write out-of-the money calls. You should know that this strategy for enhancing one’s income is not without risk. The call writer is trading the stock’s upside potential for the call premium. The desirability of writing a covered call to enhance income depends upon the chance that the stock price will exceed the exercise price at which the trader writes the call. This is similar reasoning to selling (or going short) a put. A put is in-the-money when the exercise price is above the stock price. Since the seller of a put prefers that the buyer just pay the premium and never exercise, the seller wants the price of the stock to remain above the exercise price.

作者: Baran 时间: 2009-6-25 13:21

3、Which of the following combinations resemble(s) the payoff of a covered call position?

Long stock plus a long put.

Short put plus cash.

Short stock plus long call.

Short call plus cash.

A) II only.

B) I and II only.

C) III only.

D) III and IV only.

作者: Baran 时间: 2009-6-25 13:21

The correct answer is A

A covered call combines a long position in a stock with a written call. The payoff is similar to cash plus a short put option because the upside is capped at the strike price plus the premium, but still has the downside of the strike price less the stock price. Note that a long stock plus a long put is a protective put. A short stock plus long call will profit as the stock price declines, but if the stock price rises, losses are limited by the long call. A short call plus cash receives a premium, but has unlimited downside if the price of the stock rises.

作者: Baran 时间: 2009-6-25 13:23

AIM 2: List, define, and explain the use of spread strategies, including bull spread, bear spread, calendar spread, and butterfly spread.

1、A bear spread is an option strategy in which the option trader:

A) sells a low strike call option and sells a higher strike put option.

B) purchases a low strike put option and sells a higher strike call option.

C) purchases a high strike call option and sells a lower strike call option.

D) sells a low strike put option and buys a higher strike call option.

作者: Baran 时间: 2009-6-25 13:23

The correct answer is C

Bear spreads are those in which an option trader buys a high strike call option and sells a lower strike call.

作者: Baran 时间: 2009-6-25 13:23

2、A bear spread is an option strategy in which the option trader:

A) sells a high strike call option and buys a lower strike call option.

B) purchases a high strike put option and sells a lower strike call option.

C) purchases a high strike call option and sells a lower strike call option.

D) sells a high strike put option and buys a lower strike call option.

作者: Baran 时间: 2009-6-25 13:24

The correct answer is C

Bear spreads are those in which an option trader buys a high strike call option and sells a lower strike call.

作者: Baran 时间: 2009-6-25 13:24

3、Dennis Austin works for O’Reilly Capital Management and manages endowments and trusts for large clients. The fund invests most of its portfolio in S& 500 stocks, keeping some cash to facilitate purchases and withdrawals. The fund’s performance has been quite volatile, losing over 20 percent last year but reporting gains ranging from 5 percent to 35 percent over the previous five years. O’Reilly’s clients have many needs, goals, and objectives, and Austin is called upon to design investment strategies for their clients. Austin is convinced that the best way to deliver performance is to, whenever possible, combine the fund’s stock portfolio with option positions on equity.

500 stocks, keeping some cash to facilitate purchases and withdrawals. The fund’s performance has been quite volatile, losing over 20 percent last year but reporting gains ranging from 5 percent to 35 percent over the previous five years. O’Reilly’s clients have many needs, goals, and objectives, and Austin is called upon to design investment strategies for their clients. Austin is convinced that the best way to deliver performance is to, whenever possible, combine the fund’s stock portfolio with option positions on equity.

Given the following scenario:

Performance to Date: Up 3%

Client Objective: Stay positive

Austin's scenario: Low stock price volatility between now and end of year.

Which is the best option strategy to meet the client's objective?

A) Bull call.

B) Protective put.

C) 2:1 Ratio Spread.

D) Long butterfly.

作者: Baran 时间: 2009-6-25 13:24

The correct answer is D

Long butterfly is the choice as this combination produces gains should stock prices not move either up or down, while not producing much in loss if prices are volatile. None of the other positions produce gains should stock prices not move much. The protective put guards against falling prices, the bull call limits losses and gains should prices move, and the 2:1 ratio spread gains should prices move up.

作者: Baran 时间: 2009-6-25 13:25

Given the following scenario:

Performance to Date: Up 16%

Client Objective: Earn at least 15%

Austin's scenario: Good chance of large gains or large losses between now and end of year.

Which is the best option strategy to meet the client's objective?

A) Long straddle.

B) Short straddle.

C) Long butterfly.

D) Condor.

作者: Baran 时间: 2009-6-25 13:25

The correct answer is A

Long straddle produces gains if prices move up or down, and limited losses if prices do not move. Short straddle produces significant losses if prices move significantly up or down. Long Butterfly also produces losses should prices move either up or down. The condor is similar to the long butterfly, although the gains for no movement are not as great.

作者: Baran 时间: 2009-6-25 13:25

Given the following scenario:

Performance to Date: Up 16%

Client Objective: Earn at least 15%

Austin's scenario: Good chance of large losses between now and end of year.

Which is the best option strategy to meet the client's objective?

A) Long put options.

B) Long call options.

C) Short call options.

D) Short put options.

作者: Baran 时间: 2009-6-25 13:26

The correct answer is A

Long put positions gain when stock prices fall and produce very limited losses if prices instead rise. Short calls also gain when stock prices fall but create losses if prices instead rise. The other two positions will not protect the portfolio should prices fall.

作者: Baran 时间: 2009-6-25 13:26

AIM 4: List, define, and explain the use of combination strategies, including straddles, strangles, strips, or straps.

1、A short straddle comprises a trading combination of options that:

A) sells a put and call option at the same strike price.

B) purchases a put and call option at the same strike price.

C) sells a low strike call option and buys a higher strike call option.

D) purchases a low strike call option and sells a higher strike call option.

作者: Baran 时间: 2009-6-25 13:27

The correct answer is A

A short straddle is a situation in which both a call and a put with the same strike price are sold.

作者: Baran 时间: 2009-6-25 13:27

2、The buyer of a straddle on a stock is most likely to benefit:

A) if the volatility of the underlying asset’s price decreases.

B) if the position expires worthless.

C) under all conditions because the straddle is guaranteed a risk-free rate of return.

D) if the volatility of the underlying asset’s price increases.

作者: Baran 时间: 2009-6-25 13:28

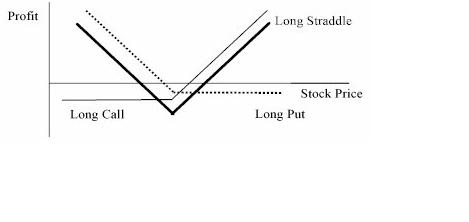

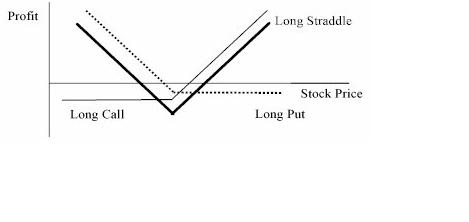

The correct answer is D

The buyer of the straddle purchases both a call and a put. This position will benefit from large swings of the price of the underlying stock in either direction. If the position expires worthless, which occurs when the stock price stays flat, the investor will lose 100% of the investment. The payoff diagram is:

[attach]13852[/attach]

[此贴子已经被作者于2009-6-25 13:28:38编辑过]

图片附件: 1.jpg (2009-6-25 13:28, 8.14 KB) / 下载次数 0

图片附件: 1.jpg (2009-6-25 13:28, 8.14 KB) / 下载次数 0

http://forum.theanalystspace.com/attachment.php?aid=34611&k=7a99b548a327f5700905fe030152399f&t=1734497155&sid=U5zGw0

作者: Baran 时间: 2009-6-25 13:30

AIM 3: Compute the pay-offs of various spread strategies.

1、Assume that the current price of a stock is $100. A call option on that stock with an exercise price of $97 costs $7. A call option on the stock with the same expiration and an exercise price of $103 costs $3. Using these options what is the profit for a long bull spread if the stock price at expiration of the options is equal to $110?

A) -$2.

B) $0.

C) $6.

D) $2.

作者: Baran 时间: 2009-6-25 13:30

The correct answer is D

The buyer of a bull spread buys the call with an exercise price below the current stock price and sells the call option with an exercise price above the stock price. Therefore, for a stock price of $110 at expiration of the options, he gets a payoff $13 from his long position and a payoff of -$7 from his short position for a net payoff of $6. The cost of the strategy is $4. Hence the profit is equal to $2.

作者: Baran 时间: 2009-6-25 13:31

2、Assume that the current price of a stock is $100. A call option on that stock with an exercise price of $97 costs $7. A call option on the stock with the same expiration and an exercise price of $103 costs $3. Using these options what is the cost of entering into a long bull spread on this stock?

A) $1.

B) $0.

C) $4.

D) $7.

作者: Baran 时间: 2009-6-25 13:31

The correct answer is C

The buyer of a bull spread buys the call with an exercise price below the current stock price and sells the call option with an exercise price above the stock price. The cost of the strategy is the difference between the cost of buying the option with the lower exercise price and selling the option with the higher exercise price which is $7 - $3 = $4 to enter into this strategy.

作者: Baran 时间: 2009-6-25 13:32

3、Assume that the current price of a stock is $100. A call option on that stock with an exercise price of $97 costs $7. A call option on the stock with the same expiration and an exercise price of $103 costs $3. Using these options what is the expiration profit of a bear call spread if the stock price is equal to $110?

A) -$6.

B) -$2.

C) $2.

D) $6.

作者: Baran 时间: 2009-6-25 13:32

The correct answer is B

The trader of a bear call spread sells the call with an exercise price below the current stock price and buys the call option with an exercise price above the stock price. Therefore, for a stock price of $110 at expiration of the options, the buyer realizes a payoff of -$13 from his short position and a positive payoff of $7 from his long position for a net payoff of -$6. The revenue of the strategy is $4. Hence the profit is equal to -$2.

作者: Baran 时间: 2009-6-25 13:32

AIM 5: Compute the pay-offs of combination strategies.

1、What is the expiration payoff of a long straddle, with an exercise price $100, if the underlying stock price is $125?

A) -$25.

B) $25.

C) $0.

D) $50.

作者: Baran 时间: 2009-6-25 13:32

The correct answer is B

A long straddle consists of a long call and put with the same exercise price and the same expiration, at a stock price of $125 the put will expire worthless and the call value will be $25.

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) |

Powered by Discuz! 7.2 |

500 stocks, keeping some cash to facilitate purchases and withdrawals. The fund’s performance has been quite volatile, losing over 20 percent last year but reporting gains ranging from 5 percent to 35 percent over the previous five years. O’Reilly’s clients have many needs, goals, and objectives, and Austin is called upon to design investment strategies for their clients. Austin is convinced that the best way to deliver performance is to, whenever possible, combine the fund’s stock portfolio with option positions on equity.

500 stocks, keeping some cash to facilitate purchases and withdrawals. The fund’s performance has been quite volatile, losing over 20 percent last year but reporting gains ranging from 5 percent to 35 percent over the previous five years. O’Reilly’s clients have many needs, goals, and objectives, and Austin is called upon to design investment strategies for their clients. Austin is convinced that the best way to deliver performance is to, whenever possible, combine the fund’s stock portfolio with option positions on equity.