AIM 1: Discuss and assess the risks associated with naked and covered option positions.

1、As an option approaches expiration, the value of rho for a put option:

A) decreases and tends toward zero.

B) decreases and tends toward negative infinity.

C) increases and tends toward infinity.

D) increases and tends toward zero.

The correct answer is D

Rho values for put options are always negative and approach zero as the option nears maturity.

AIM 3: Define delta hedging for an option, forward, and futures contracts.

1、Ronald Franklin, CFA, has recently been promoted to junior portfolio manager for a large equity portfolio at Davidson-Sherman (DS), a large multinational investment-banking firm. He is specifically responsible for the development of a new investment strategy that DS wants all equity portfolio managers to implement. Upper management at DS has instructed its portfolio managers to begin overlaying option strategies on all equity portfolios. The relatively poor performance of many of their equity portfolios has been the main factor behind this decision. Prior to this new mandate, DS portfolio managers had been allowed to use options at their own discretion, and the results were somewhat inconsistent. Some portfolio managers were not comfortable with the most basic concepts of option valuation and their expected return profiles, and simply did not utilize options at all. Upper management of DS wants Franklin to develop an option strategy that would be applicable to all DS portfolios regardless of their underlying investment composition. Management views this new implementation of option strategies as an opportunity to either add value or reduce the risk of the portfolio.

Franklin gained experience with basic options strategies at his previous job. As an exercise, he decides to review the fundamentals of option valuation using a simple example. Franklin recognizes that the behavior of an option's value is dependent on many variables and decides to spend some time closely analyzing this behavior. His analysis has resulted in the information shown in Exhibits 1 and 2 for European style options.

|

Exhibit 1: Input for European Options | |

|

Stock Price (S) |

100 |

|

Strike Price (X) |

100 |

|

Interest Rate (r) |

0.07 |

|

Dividend Yield (q) |

0.00 |

|

Time to Maturity (years) (t) |

1.00 |

|

Volatility (Std. Dev.)(Sigma) |

0.20 |

|

Black-Scholes Put Option Value |

$4.7809 |

|

Exhibit 2: European Option Sensitivities | ||

|

Sensitivity |

Call |

Put |

|

Delta |

0.6736 |

-0.3264 |

|

Gamma |

0.0180 |

0.0180 |

|

Theta |

-3.9797 |

2.5470 |

|

Vega |

36.0527 |

36.0527 |

|

Rho |

55.8230 |

-37.4164 |

Franklin wants to know if the option sensitivities shown in Exhibit 2 have minimum or maximum bounds. Which of the following are the minimum and maximum bounds, respectively, for the put option delta?

A) -1 and 1.

B) -1 and 0.

C) -1 and no maximum bound.

D) There are no minimum or maximum bounds.

The correct answer is B

The lower bound is achieved when the put option is far in the money so that it moves exactly in the opposite direction as the stock price. When the put option is far out of the money, the option delta is zero. Thus, the option price does not move even if the stock price moves since there is almost no chance that the option is going to be worth something at expiration.

2、Ronald Franklin, CFA, has recently been promoted to junior portfolio manager for a large equity portfolio at Davidson-Sherman (DS), a large multinational investment-banking firm. He is specifically responsible for the development of a new investment strategy that DS wants all equity portfolio managers to implement. Upper management at DS has instructed its portfolio managers to begin overlaying option strategies on all equity portfolios. The relatively poor performance of many of their equity portfolios has been the main factor behind this decision. Prior to this new mandate, DS portfolio managers had been allowed to use options at their own discretion, and the results were somewhat inconsistent. Some portfolio managers were not comfortable with the most basic concepts of option valuation and their expected return profiles, and simply did not utilize options at all. Upper management of DS wants Franklin to develop an option strategy that would be applicable to all DS portfolios regardless of their underlying investment composition. Management views this new implementation of option strategies as an opportunity to either add value or reduce the risk of the portfolio.

Franklin gained experience with basic options strategies at his previous job. As an exercise, he decides to review the fundamentals of option valuation using a simple example. Franklin recognizes that the behavior of an option's value is dependent on many variables and decides to spend some time closely analyzing this behavior. His analysis has resulted in the information shown in Exhibits 1 and 2 for European style options.

|

Exhibit 1: Input for European Options | |

|

Stock Price (S) |

100 |

|

Strike Price (X) |

100 |

|

Interest Rate (r) |

0.07 |

|

Dividend Yield (q) |

0.00 |

|

Time to Maturity (years) (t) |

1.00 |

|

Volatility (Std. Dev.)(Sigma) |

0.20 |

|

Black-Scholes Put Option Value |

$4.7809 |

|

Exhibit 2: European Option Sensitivities | ||

|

Sensitivity |

Call |

Put |

|

Delta |

0.6736 |

-0.3264 |

|

Gamma |

0.0180 |

0.0180 |

|

Theta |

-3.9797 |

2.5470 |

|

Vega |

36.0527 |

36.0527 |

|

Rho |

55.8230 |

-37.4164 |

Which of the following is the best estimate of the change in the put option when the underlying equity increases by $1?

A) -$3.61.

B) -$0.33.

C) -$0.37.

D) $0.67.

The correct answer is B

The correct value is simply the delta of the put option in Exhibit 2.

The incorrect value -$3.61 represents the change due to the volatility divided by 10 multiplied by –1.

The incorrect value -$0.37 calculates the change by dividing the short-term interest rate divided by 100.

The incorrect value $0.67 represents the change in the call option.

Franklin computes the rate of change in the European put option delta value, given a $1 increase in the underlying equity. Using the information in Exhibits 1 and 2, which of the following is the closest to Franklin's answer?

A) -0.3264.

B) 0.6736.

C) 0.0180.

D) 36.0527.

The correct answer is C

The correct value 0.0180 is referred to as the put option's Gamma.

The incorrect value -0.3264 is the delta of the put option.

The incorrect value 0.6736 is the call option's delta.

The incorrect value 36.0527 is the put option's Vega.

3、Which of the following is the best interpretation of delta for an option? Delta is the change in the option price for:

A) an instantaneous change in interest rates.

B) an instantaneous change in price of the underlying stock.

C) a change in the time until expiration of the option.

D) an instantaneous change in the volatility of the underlying stock.

The correct answer is B

Delta is the slope of the price function of the call option payoff diagram.

4、An option dealer is delta hedging a short call position on a stock. As the stock price increases, in order to maintain the hedge, the dealer would most likely have to:

A) buy more shares of the stock.

B) sell some the shares of the stock.

C) buy T-bills.

D) short T-bills.

The correct answer is A

As the value of the underlying increases, the delta of a call option increases. This means more of the underlying asset is needed to hedge the position.

5、To create a delta-neutral portfolio, an investor who has written 5,000 call options that have deltas equal to 0.5 will be:

A) short 2,500 shares in the underlying.

B) long 2,500 shares in the underlying and short 2,500 more options.

C) long 2,500 shares in the underlying.

D) short 2,500 shares in the underlying and be short 2,500 more options.

The correct answer is C

If the investor has written 5,000 call options, he then must go long 0.5 × 5,000 = 2,500 shares to create a delta neutral position since the delta of a share is 1.

AIM 4: Compute delta for an option.

1、The deltas of puts and calls are most sensitive to changes in the underlying when:

A) both calls and puts are deep in-the-money.

B) both puts and calls are deep out-of-the-money.

C) calls are deep out-of-the-money, but puts are deep in-the-money.

D) both calls and puts are at-the-money.

The correct answer is D

Call and put deltas are the most sensitive to changes in the underlying security (i.e., gammas are largest) when the option is at-the-money.

2、Which of the following is FALSE?

The delta of forwards and futures is 1.

Gamma is largest when options are at-the-money.

Two problems using stop-loss trading on naked options are transaction costs and stock price uncertainty.

For a delta-neutral portfolio, although opposite in sign, theta can serve as a proxy for gamma.

A) II only.

B) I and III only.

C) II and IV only.

D) I only.

The correct answer is D

The delta of forwards is one. The delta of futures is not usually one. Two problems using stop-loss trading on naked options are transaction costs and stock-price certainty. Gamma is largest when options are at-the-money. For a delta-neutral portfolio, although opposite in sign, theta can serve as a proxy for gamma.

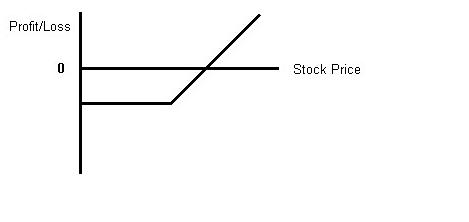

The correct answer is A

The above diagram is for a long stock, long put strategy (portfolio insurance). The loss is limited to the cost of the option while the potential upside profit is unlimited. Note that the portfolio insurance payoff diagram is identical to the profit/loss diagram for a long call option, however a long call is not one of the answer choices.

AIM 8: Define, compute and discuss theta, gamma, vega, and rho for option positions.

1、Which of the following is the best approximation of the gamma of an option if its delta is equal to 0.6 when the price of the underlying security is 100 and 0.7 when the price of the underlying security is 110?

A) 0.00.

B) 0.01.

C) 0.10.

D) 1.00.

The correct answer is B

The gamma of an option is computed as follows:

Gamma = change in delta/change in the price of the underlying = (0.7 – 0.6)/(110 – 100) = 0.01

2、How is the gamma of an option defined? Gamma is the change in the:

A) vega as the option price changes.

B) theta as the option price changes.

C) delta as the price of the underlying security changes.

D) option price as the underlying security changes.

The correct answer is C

Gamma is the rate of change in delta. It measures how fast the price sensitivity changes as the underlying asset price changes.

3、When an option’s gamma is higher:

A) delta will be lower.

B) delta will be higher.

C) a delta hedge will perform more poorly over time.

D) a delta hedge will be more effective.

The correct answer is C

Gamma measures the rate of change of delta (a high gamma could mean that delta will be higher or lower) as the asset price changes and, graphically, is the curvature of the option price as a function of the stock price. Delta measures the slope of the function at a point. The greater gamma is (the more delta changes as the asset price changes), the worse a delta hedge will perform over time.

4、Gamma is the greatest when an option:

A) is deep in the money.

B) is deep out of the money.

C) is at the money.

D) has a shorter maturity.

The correct answer is C

Gamma, the curvature of the option-price/asset-price function, is greatest when the asset is at the money.

5、Call and put option values are most sensitive to changes in the volatility of the underlying when:

A) both calls and puts are deep in-the-money.

B) both puts and calls are deep out-of-the-money.

C) calls are deep out-of-the-money and puts are deep in-the-money.

D) both calls and puts are at-the-money.

The correct answer is D

Vega measures the sensitivity of the option value to changes in volatility. Vega is at a maximum when calls and put options are at-the-money.

AIM 9: Explain how to implement and maintain a gamma-neutral position.

1、Gamma-neutral hedging:

A) increases sensitivity to small changes in asset prices.

B) decreases sensitivity to small changes in asset prices.

C) increases sensitivity to large changes in asset prices.

D) decreases sensitivity to large changes in asset prices.

The correct answer is D

Gamma-neutral hedging is designed to mitigate the effect of large changes in asset prices on delta-neutral positions that are designed to protect against small changes in asset prices.

2、Which of the following is least accurate regarding a gamma hedge?

A) More frequent rebalancing of a gamma hedge should result in higher returns.

B) Gamma hedges require less frequent rebalancing than delta hedges.

C) The gamma increases with larger changes in the stock price.

D) Gamma measures the change in delta.

The correct answer is A

Gamma measures the change in delta. Gamma becomes larger as the changes in stock price increase in absolute value. Gamma hedging requires less frequent rebalancing than delta hedging. Less frequent rebalancing in a gamma hedge can result in higher returns but also increases the position’s volatility.

蔷薇老妈整形前后对比图

蔷薇老妈的成名、励志之路

许燕玲整形前后对比图

不远千里挑战南国“美魔女”| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |