AIM 2: Derive of the basic equilibrium formula for pricing commodity forwards and futures.

1、All of the following statements describing the formulation of synthetic forward commodity are correct EXCEPT:

I. A synthetic commodity forward price can be derived by combining a long position on a commodity forward, F0,T, and a long zero-coupon bond that pays F0,T at time T.

II. The total cost at time 0 is equivalent to the cost of the bond, or e-rTF0,T.

III. The payoff at time T is ST – F0,T + F0,T = ST.

A) I only.

B) II only.

C) III only.

D) All of the statements are correct.

The correct answer is D

All of the statements are correct. A synthetic commodity forward price can be derived by combining a long position on a commodity forward, F0,T , and a long zero-coupon bond that pays F0,T at time T. The total cost at time 0 is equivalent to the cost of the bond, e-rTF0,T. The forward contract does not have any initial cash flows at time 0. The payoff at time T is ST – F0,T + F0,T = ST, where ST is the spot price of the commodity at time T. The present value of the expected spot price at time T is E(ST)e–αT. This amount is equivalent to the cost of the bond, e-rTF0,T, because both represent the amount you would pay today to receive the commodity at time T.

AIM 6: Define the lease rate and how it determines the no-arbitrage values for commodity forwards and futures, and explain the relationship between lease rates and contango and lease rates and backwardation, respectively.

1、Which of the following statements regarding the lease rate in commodity futures contracts is incorrect?

The lease rate is the return required by the lender in exchange for lending a commodity.

Assuming it is positive, as the lease rate increases, the futures price for a commodity increases.

In a cash-and-carry arbitrage, the lease rate is earned whether or not the underlying commodity is actually loaned.

Lease rates are similar to dividends paid to the lender of a share of common stock.

If the lease rate is less than the risk-free rate, the forward market is said to be in contango.

A) III and V.

B) I, III, and V.

C) II and IV.

D) II and III.

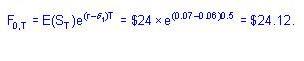

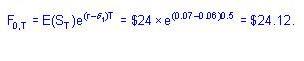

2、The expected spot rate in six months for a commodity is $24. The annual lease rate is 6 percent for the commodity. The appropriate continuously compounding annual risk-free rate for the commodity is equivalent to 7 percent. What is the 6-month commodity forward rate?

A) $24.12.

B) $23.91.

C) $24.00.

D) $24.22.

The correct answer is D

The lease rate is the amount that a lender requires as compensation for lending a commodity. In determining the price of a commodity futures contract, the lease rate, δl, is subtracted from the risk-free rate, r, as follows:

[attach]13877[/attach]

Assuming a positive lease rate, the lease rate effectively reduces the futures price, all else constant. This also assumes that there is an active market for lending the commodity underlying the futures contract. The lease rate can only be earned by actually lending the underlying commodity.

[此贴子已经被作者于2009-6-26 14:09:57编辑过]

The correct answer is A

The 6-month forward rate is calculated as follows:

3、Which of the following is TRUE in normal backwardation? Futures prices tend to:

A) fall over the life of the contract because hedgers are net short and have to receive compensation for bearing risk.

B) fall over the life of the contract because speculators are net short and have to receive compensation for bearing risk.

C) rise over the life of the contract because hedgers are net long and have to receive compensation for bearing risk.

D) rise over the life of the contract because speculators are net long and have to receive compensation for bearing risk.

The correct answer is D

Normal backwardation means that expected futures spot prices are greater than futures prices. It suggests that when hedgers are net short futures contracts, they must sell them at a discount to the expected future spot prices to get speculators to assume the risk of holding a net long position. The futures price rises over the life of the contract, which compensates speculators for the exposure of their long positions.

AIM 8: Explain the impact storage costs and convenience yields have on commodity forward prices and no-arbitrage bounds.

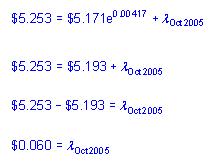

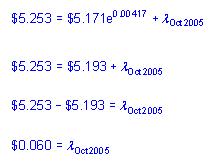

1、If the October 2005 spot price for natural gas is 5.171, the annual risk-free rate of interest is 5 percent, and the November forward price is 5.253. What is the natural gas implied storage cost for the month of October?

A) 0.043.

B) 0.060.

C) 0.057.

D) 0.075.

The correct answer is B

The implied storage cost for October is calculated as follows:

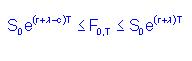

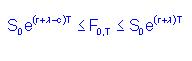

2 、Suppose the owner of a commodity decides to lend out the commodity. If the commodity has a continuously compounded convenience yield of c, proportional to the value of the commodity, which of the following best represents the lowest forward price?

The correct answer is B

The owner of a commodity is able to create a range of no-arbitrage prices as follows: .

The lower bound adjusts for the convenience yield and therefore explains why forward prices may appear lower at times when the convenience yield is not accounted for. The upper bound depends on storage costs but not on the convenience yield.

AIM 11: Discuss factors that impact gold, corn, natural gas, and crude oil futures prices.

1、Consider the factors that affect the price of futures contracts on various commodities. Which of the following statements does not accurately describe the relationship between a commodity’s futures price and its underlying factors?

A) Natural gas is produced relatively consistently but has seasonal demand, causing the futures price to rise steadily in the fall months, since natural gas is too expensive to store.

B) The cost of storing corn, which has relatively constant demand, causes the futures price to rise until the next harvest at which point the price falls.

C) Relatively constant worldwide demand for oil and its ability to be cheaply transported keep oil prices relatively stable in the absence of short-run supply and demand.

D) Gold futures have an implicit lease rate which, because it is not actually paid by commodity borrowers, creates incentive to hold physical rather than synthetic gold as ideal strategy to gain gold exposure.

The correct answer is D

Gold can be loaned out to financial intermediaries and other investors willing to pay the lease rate (the price for borrowing the gold) to the lender. Thus, holding physical gold requires the investor to forgo earning the lease rate while also incurring storage costs. Therefore, the ideal gold exposure strategy is generally to hold synthetic gold.

2、Which of the following commodities is an example of seasonal production and constant demand?

A) Corn.

B) Gold.

C) Natural gas.

D) Oil.

The correct answer is A

Corn is an example of a commodity with seasonal production and a constant demand. Corn is produced in the fall of every year, but it is consumed throughout the year.

3、Which of the following commodities is an example of constant production and seasonal demand?

A) Gold.

B) Corn.

C) Natural gas.

D) Oil.

The correct answer is C

Natural gas is an example of a commodity with constant production but seasonal demand.

4、Which of the following commodities is very difficult to store and transport?

A) Gold.

B) Corn.

C) Natural gas.

D) Oil.

The correct answer is C

Natural gas is expensive to store, and demand in the United States peaks during high periods of use in the winter months. In addition, the price of natural gas is different for various regions due to high international transportation costs.

AIM 12: Define and compute a commodity spread.

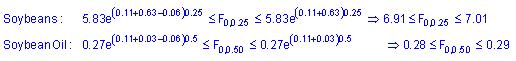

1、A hedge fund specializing in commodity related derivatives is considering a crush spread position using soybean and soybean oil futures contracts. Using the information in the table below, determine which of the following statements is correct.

|

< >> |

Soybeans |

Soybean Oil |

|

Spot Price |

$5.83/bushel |

$0.27/pound |

|

Storage Cost* |

0.63/bushel |

0.03/pound |

|

Convenience Yield* |

6% |

6% |

|

Interest rate* |

11% |

11% |

|

Time to expiration |

3 months |

6 months |

*Continuously compounded annual rates

A) The hedge fund should establish a long position in the soybean futures contract for no more than $6.91 and a short position in the soybean oil contract for no less than $0.29.

B) The hedge fund should establish a short position in the soybean futures contract for no less than $7.01 and a long position in the soybean oil contract for no less than $0.28.

C) The hedge fund should establish a long position in the soybean futures contract for no more than $7.01 and a long position in the soybean oil contract for no more than $0.29.

D) The hedge fund should establish a long position in the soybean futures contract for no more than $7.01 and a short position in the soybean oil contract for no less than $0.28.

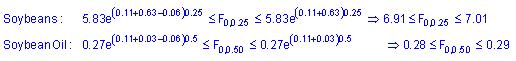

The correct answer is D

When a convenience yield is associated with a commodity, the futures price on that commodity becomes a range, rather than a single value. The range is expressed in the following formula:

Using this formula, we can calculate the range of futures prices acceptable for the soybean and soybean oil futures contracts as follows::

For a crush spread, the investor goes long (short) a soybean futures contract and then takes a short (long) position in a soybean meal futures contract.ffice ffice" />

ffice" />

2、Which of the following results from a commodity that is an input in the production process of other commodities?

A) Implied lease rate.

B) Commodity spread.

C) Implied forward rate.

D) Convenience yield.

The correct answer is B

A commodity spread results from a commodity that is an input in the production process of other commodities.

AIM 14: Evaluate the differences between a strip hedge and a stack hedge and analyze how these differences impact risk management.

1、How could an oil refiner hedge the risk of an agreement to supply 50,000 barrels of oil each month for a year at a fixed price? The oil refiner could enter a:

I. long futures contract position for every month for 50,000 barrels.

II. short futures contract position for every month for 50,000 barrels.

III. long near-term futures contract for 600,000 barrels.

IV. short near-term futures contract for 50,000 barrels.

A) I only.

B) I and III only.

C) II only.

D) II and IV only.

The correct answer is B

The oil refiner could enter into a strip hedge, by obtaining a long futures contract position for every month of the year for 50,000 barrels. Alternatively, the oil refiner could create a long position of a near-term futures contract for approximately 600,000 barrels.

2、Which of the following statements regarding controlling risk with derivatives is FALSE?

A) In a strip hedge, the portfolio manager buys more of the nearest-term futures contract than the amount the manager is hedging.

B) To reduce the duration of a current portfolio to a target duration, a portfolio manager can sell T-bond futures contracts.

C) To calculate the dollar duration of a portfolio, the manager multiplies the effective duration times the basis point movement times the value of the position.

D) Credit spread risk refers to the risk that the difference between the yield on a risky asset and the yield on a risk-free asset increases.

The correct answer is A

In a stack hedge, the portfolio manager buys more of the nearest-term futures contract than the amount the manager is hedging.

3、Which of the following is a difference between a strip and a stack hedge? A stack hedge uses:

A) out-of-the money put options.

B) a combination of long and short positions in different futures expirations.

C) futures contracts that are concentrated in a single futures expiration.

D) futures contracts on assets that are related to, but different, from the hedged asset.

The correct answer is C

4、Which of the following is the main motivation behind using a strip hedge instead of using a stack hedge? A strip hedge is:

A) cheaper.

B) a more effective interest rate risk hedging strategy for multiple cash flows.

C) more suitable for a single large cash flow.

D) Able to hedge against both interest rate risk and volatility risk.

The correct answer is B

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |