1.Calculate the price (expressed as an annualized rate) of a 1x4 forward rate agreement (FRA) if the current 30-day rate is 5 percent and the 120-day rate is 7 percent.

A) 7.47%.

B) 9.32%.

C) 6.86%.

D) 7.63%.

2.Monica Lewis, CFA, has been hired to review data on a series of forward contracts for a major client. The client has asked for an analysis of a contract with each of the following characteristics:

1. A forward contract on a U.S. Treasury bond

2. A forward rate agreement (FRA)

3. A forward contract on a currency

Information related to a forward contract on a

Information related to a forward rate agreement: The relevant contract is a 3 x 9 FRA. The current annualized 90-day money market rate is 3.5 percent and the 270-day rate is 4.5 percent. Based on the best available forecast, the 180-day rate at the expiration of the contract is expected to be 4.2 percent.

Information related to a forward contract on a currency: The risk-free rate in the

Based on the information given, what initial price should Lewis recommend for a forward contract on the Treasury bond?

A) $1,035.12.

B) $1,070.02.

C) $1,073.54.

D) $1,053.66.

3.Suppose that the price of the forward contract for the Treasury bond was negotiated off-market and the initial value of the contract was positive as a result. Which party makes a payment and when is the payment made?

A) The long pays the short at the maturity of the contract.

B) The short pays the long at the initiation of the contract.

C) The long pays the short at the initiation of the contract.

D) The short pays the long at the maturity of the contract.

4.Suppose that instead of a forward contract on the Treasury bond, a similar futures contract was being considered. Which one of the following alternatives correctly gives the preference that an investor would have between a forward and a futures contract on the Treasury bond?

A) The futures contract will be preferred to the forward contract.

B) The forward contract will be preferred to the futures contract.

C) An investor would be indifferent between the two types of contracts.

D) It is impossible to say for certain because it depends on the correlation between the underlying asset and interest rates.

5.Based on the information given, what initial price should Lewis recommend for the 3 x 9 FRA?

A) 4.66%.

B) 5.96%.

C) 5.66%.

D) 4.96%.

1.Calculate the price (expressed as an annualized rate) of a 1x4 forward rate agreement (FRA) if the current 30-day rate is 5 percent and the 120-day rate is 7 percent.

A) 7.47%.

B) 9.32%.

C) 6.86%.

D) 7.63%.

The correct answer was D)

A 1x4 FRA is a 90-day loan, 30 days from today.

The actual rate on the 30-day loan is: R30 = 0.05 x 30/360 = 0.004167

The actual rate on the 120-day loan is: R120 = 0.07 x 120/360 = 0.02333

FR (30,90) = [(1+ R120)/(1+ R30)] – 1 = (1.023333/1.004167) – 1 = 0.0190871

The annualized 90-day rate = 0.0190871 x 360/90 = .07634 = 7.63%

2.Monica Lewis, CFA, has been hired to review data on a series of forward contracts for a major client. The client has asked for an analysis of a contract with each of the following characteristics:

1. A forward contract on a U.S. Treasury bond

2. A forward rate agreement (FRA)

3. A forward contract on a currency

Information related to a forward contract on a

Information related to a forward rate agreement: The relevant contract is a 3 x 9 FRA. The current annualized 90-day money market rate is 3.5 percent and the 270-day rate is 4.5 percent. Based on the best available forecast, the 180-day rate at the expiration of the contract is expected to be 4.2 percent.

Information related to a forward contract on a currency: The risk-free rate in the

Based on the information given, what initial price should Lewis recommend for a forward contract on the Treasury bond?

A) $1,035.12.

B) $1,070.02.

C) $1,073.54.

D) $1,053.66.

The correct answer was B)

The forward price (FP) of a fixed income security is the future value of the spot price net of the present value of expected coupon payments during the life of the contract. In a formula:

FP = (S0 – PVC) x (1 + Rf)T

A 6 percent coupon translates into semiannual payments of $30. With a risk-free rate of 5 percent and 183 days until the next coupon we can find the present value of the coupon payments from:

PVC = $30/(1.05)183/365 = $29.28.

With 195 days to maturity the forward price is:

FP = ($1,071.77 – $29.28) x (1.05)195/365 = $1,070.02.

3.Suppose that the price of the forward contract for the Treasury bond was negotiated off-market and the initial value of the contract was positive as a result. Which party makes a payment and when is the payment made?

A) The long pays the short at the maturity of the contract.

B) The short pays the long at the initiation of the contract.

C) The long pays the short at the initiation of the contract.

D) The short pays the long at the maturity of the contract.

The correct answer was C)

If the value of a forward contract is positive at initiation then the long pays the short the value of the contract at the time it is entered into. If the value of the contract is negative initially then the short pays the long the absolute value of the contract at the time the contract is entered into.

4.Suppose that instead of a forward contract on the Treasury bond, a similar futures contract was being considered. Which one of the following alternatives correctly gives the preference that an investor would have between a forward and a futures contract on the Treasury bond?

A) The futures contract will be preferred to the forward contract.

B) The forward contract will be preferred to the futures contract.

C) An investor would be indifferent between the two types of contracts.

D) It is impossible to say for certain because it depends on the correlation between the underlying asset and interest rates.

The correct answer was B)

The forward contract will be preferred to a similar futures contract precisely because there is a negative correlation between bond prices and interest rates. Fixed income values fall when interest rates rise. Borrowing costs are higher when funds are needed to meet margin requirements. Similarly reinvestment rates are lower when funds are generated by the mark to market of the futures contract. Consequently the mark to market feature of the futures contract will not be preferred by a typical investor.

5.Based on the information given, what initial price should Lewis recommend for the 3 x 9 FRA?

A) 4.66%.

B) 5.96%.

C) 5.66%.

D) 4.96%.

The correct answer was D)

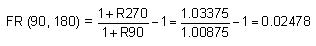

The price of an FRA is expressed as a forward interest rate. A 3 x 9 FRA is a 180-day loan, 90 days from now. The current annualized 90-day money market rate is 3.5 percent and the 270-day rate is 4.5 percent. The actual (unannualized) rates on the 90-day loan (R90) and the 270-day loan (R270) are:

R90 = 0.035 x (90/360) = 0.00875

R270 = 0.045 x (270/360) = 0.03375

The actual forward rate on a loan with a term of 180 days to be made 90 days from now (written as FR (90, 180)) is:

Annualized = 0.02478 x (360/180) = 0.04957 or 4.96%.

[此贴子已经被作者于2008-4-14 15:25:59编辑过]

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |