6.Which investment is underpriced, overpriced, or properly priced according to the CAPM?

A) Discount: underpriced; Everything: overpriced.

B) Discount: overpriced; Everything: properly priced.

C) Discount: underpriced; Everything: properly priced.

D) Discount: overpriced; Everything: underpriced.

7.Harry Jordan, an associate of Michaels, recommends the $1 Discount Store investment because it has a higher forecasted return and lower risk. Is

A) Yes, because from the table, we can confirm

B) Yes, since capital market theory asserts that the return on investment is based on the amount of unsystematic risk in the investment.

C) No, because according to the CAPM model it has been determined that Discount is overvalued.

D) No, since capital market theory states that the return on investment is based on the amount of total risk in the investment.

8.Which of the following is not an assumption that is necessary to derive the CAPM?

A) Markets are perfectly competitive.

B) Limited risk-free borrowing.

C) Markets are frictionless.

D) Investors expectations are homogeneous.

9.Callard Corp. stock has a beta of 1.5. If the current risk-free interest rate is 6 percent, and the expected return on the market is 14 percent, what is the expected rate of return for Callard Corp.’s stock?

A) 20%.

B) 16%.

C) 18%.

D) 14%.

10.Figment, Inc., stock has a beta of 1.0 and a forecast return of 14 percent. The expected return on the market portfolio is 14 percent, and the long-run inflationary expectation is 3 percent. Which of the following statements is most accurate? Figment, Inc.’s stock:

A) valuation relative to the market cannot be determined.

B) is undervalued.

C) is overvalued.

D) is properly valued.

[此贴子已经被作者于2008-4-18 15:35:40编辑过]

6.Which investment is underpriced, overpriced, or properly priced according to the CAPM?

A) Discount: underpriced; Everything: overpriced.

B) Discount: overpriced; Everything: properly priced.

C) Discount: underpriced; Everything: properly priced.

D) Discount: overpriced; Everything: underpriced.

The correct answer was D)

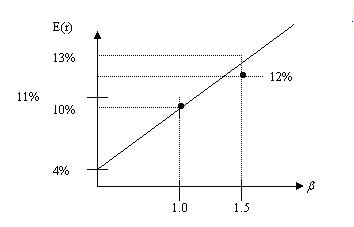

According to the CAPM, $1 Discount Stores requires a return of 13% based on its systematic risk level of β=1.5. However, the forecasted return is only 12%. Therefore, the security is current overvalued.

According to the CAPM Everything $5 requires a return of 10% based on its systematic risk level of β = 1.0. However, the forecasted return is 11%. Therefore, the security is current undervalued.

To illustrate this result graphically, we plot both securities in relation to the SML. Note that β is in the independent variable on the X-axis, not σ (total risk). Since $1 Discount is overvalued, it plots below the line while Everything $5 is undervalued and plots above the SML.

7.Harry Jordan, an associate of Michaels, recommends the $1 Discount Store investment because it has a higher forecasted return and lower risk. Is

A) Yes, because from the table, we can confirm

B) Yes, since capital market theory asserts that the return on investment is based on the amount of unsystematic risk in the investment.

C) No, because according to the CAPM model it has been determined that Discount is overvalued.

D) No, since capital market theory states that the return on investment is based on the amount of total risk in the investment.

The correct answer was C)

8.Which of the following is not an assumption that is necessary to derive the CAPM?

A) Markets are perfectly competitive.

B) Limited risk-free borrowing.

C) Markets are frictionless.

D) Investors expectations are homogeneous.

The correct answer was B)

The CAPM assumes that unlimited risk-free borrowing and lending is permitted.

9.Callard Corp. stock has a beta of 1.5. If the current risk-free interest rate is 6 percent, and the expected return on the market is 14 percent, what is the expected rate of return for Callard Corp.’s stock?

A) 20%.

B) 16%.

C) 18%.

D) 14%.

The correct answer was C)

ERcc = 0.06 + 1.5(0.14 – 0.06) = 18%

10.Figment, Inc., stock has a beta of 1.0 and a forecast return of 14 percent. The expected return on the market portfolio is 14 percent, and the long-run inflationary expectation is 3 percent. Which of the following statements is most accurate? Figment, Inc.’s stock:

A) valuation relative to the market cannot be determined.

B) is undervalued.

C) is overvalued.

D) is properly valued.

The correct answer was D)

Since Figment, Inc.’s, stock has a beta equal to 1.0, then the expected return of this stock is equal to the expected return on the market portfolio, which also has a beta of 1.0. Since Figment’s expected return is equal to its required return, the stock is properly valued.

[此贴子已经被作者于2008-4-14 17:24:57编辑过]

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |