1.The price of a June call option with an exercise price of $50 falls by $0.50 when the underlying stock price falls by $2.00. The delta of a June put option with an exercise price of $50 is closest to:

A) 0.25.

B) –0.15.

C) –0.25.

D) –0.75.

2.As a portfolio manager for the Herron Investments, an analyst is interested in establishing a dynamic hedge for one of his clients, Lou Gier. Gier has 200,000 shares of a stock that he believes could take a dive in the near future. Suppose that a call option with an exercise price of $100 and a maturity of 90 days has a price of $7. Also assume that the current stock price is $95 and the risk free rate is 5%.

Assuming that the delta value of call option is 0.70, how many call option contracts would be needed to create a delta neutral hedge?

A) 2,000 contracts.

B) 200,000 contracts.

C) 285,714 contracts.

D) 2,857 contracts.

3.When a delta neutral hedge has been established using call options, which of the following statements is most correct? As the price of the underlying stock:

A) changes, no changes are needed in the number of call options purchased.

B) changes, no changes are needed in the number of call options that are written.

C) increases, some option contracts would need to be repurchased in order to retain the delta neutral position.

D) increases, some option contracts would need to be sold in order to retain the delta neutral position.

4.An instantaneously riskless hedged portfolio has a delta of:

A) 1.

B) -1.

C) 0.

D) anything, gamma determines the instantaneous risk of a hedge portfolio.

5.The delta of an option is equal to the:

A) percentage change in option price divided by the percentage change in the asset price.

B) dollar change in the stock price divided by the dollar change in the option price.

C) percentage change in the stock price divided by the percentage change in the option price.

D) dollar change in the option price divided by the dollar change in the stock price.

6.In order to form a dynamic hedge using stock and calls with a delta of 0.2, an investor could buy 10,000 shares of stock and:

A) write 2,000 calls.

B) write 50,000 calls.

C) buy 2,000 calls.

D) buy 50,000 calls.

[此贴子已经被作者于2008-4-22 11:59:07编辑过]

1.The price of a June call option with an exercise price of $50 falls by $0.50 when the underlying stock price falls by $2.00. The delta of a June put option with an exercise price of $50 is closest to:

A) 0.25.

B) –0.15.

C) –0.25.

D) –0.75.

The correct answer was D)

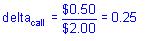

The call option delta is:

The put option delta is 0.25 – 1 = –0.75.

2.As a portfolio manager for the Herron Investments, an analyst is interested in establishing a dynamic hedge for one of his clients, Lou Gier. Gier has 200,000 shares of a stock that he believes could take a dive in the near future. Suppose that a call option with an exercise price of $100 and a maturity of 90 days has a price of $7. Also assume that the current stock price is $95 and the risk free rate is 5%.

Assuming that the delta value of call option is 0.70, how many call option contracts would be needed to create a delta neutral hedge?

A) 2,000 contracts.

B) 200,000 contracts.

C) 285,714 contracts.

D) 2,857 contracts.

The correct answer was D)

The number of call options needed is 200,000 / 0.70 = 285,714 options or approximately 2,857 contracts.

3.When a delta neutral hedge has been established using call options, which of the following statements is most correct? As the price of the underlying stock:

A) changes, no changes are needed in the number of call options purchased.

B) changes, no changes are needed in the number of call options that are written.

C) increases, some option contracts would need to be repurchased in order to retain the delta neutral position.

D) increases, some option contracts would need to be sold in order to retain the delta neutral position.

The correct answer was C)

As the stock price increases, the delta of the call option increases as well, requiring fewer option contracts to hedge against the underlying stock price movements. Therefore, some options contracts would need to be repurchased in order to maintain the hedge.

4.An instantaneously riskless hedged portfolio has a delta of:

A) 1.

B) -1.

C) 0.

D) anything, gamma determines the instantaneous risk of a hedge portfolio.

The correct answer was C)

A riskless portfolio is delta neutral, the delta is zero.

5.The delta of an option is equal to the:

A) percentage change in option price divided by the percentage change in the asset price.

B) dollar change in the stock price divided by the dollar change in the option price.

C) percentage change in the stock price divided by the percentage change in the option price.

D) dollar change in the option price divided by the dollar change in the stock price.

The correct answer was D)

The delta of an option is the dollar change in option price per $1 change in the price of the underlying asset.

6.In order to form a dynamic hedge using stock and calls with a delta of 0.2, an investor could buy 10,000 shares of stock and:

A) write 2,000 calls.

B) write 50,000 calls.

C) buy 2,000 calls.

D) buy 50,000 calls.

The correct answer was B)

Each call will increase in price by $0.20 for each $1 increase in the stock price. The hedge ratio is –1/delta or –5. A short position of 50,000 calls will offset the risk of 10,000 shares of stock over the next instant.

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |