Question 21

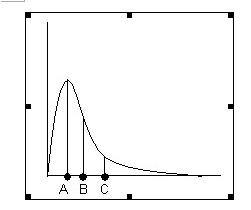

Consider the following graph of a distribution for the prices for various bottles of California-produced wine

Which of the following statements about this distribution is least accurate?

A) The distribution is positively skewed.

B) Point A represents the mode.

C) Approximately 68% of observations fall within one standard deviation of the mean.

D) The graph could be of the sample $16, $12, $15, $12, $17, $30 (ignore graph scale).

Question 22

The probability of a boom economy is 40%. The probability of Yacht Co. having a 50% return given a boom economy is 80%. The joint probability of a boom economy and a 50% return for Yacht Co. is closest to:

A) 20%.

B) 32%.

C) 40%.

D) 50%.

Question 23

Mikal Cosce uses technical analysis to determine his trading behavior. Cosce would be least likely to agree with which of the following statements?

A) He supports the weak form of the efficient market hypothesis.

B) Stock prices move in trends, and these trends persist.

C) Technical analysis tells him when to buy.

D) He does not have to rely on accounting information.

Question 24

Jane Peebles purchased a T-bill that matures in 200 days for $97,500. The face value of the bill is $100,000. The money market yield on the bill is closest to:

A) 4.6%.

B) 4.4%.

C) 4.8%.

D) 5.0%.

Question 25

Which of the following statements about capital-investment decisions is least accurate?

A) Not all projects with a positive net present value (NPV) represent good investments.

B) The NPV is generally considered to be a superior measure of value relative to the IRR.

C) A project is generally considered to be acceptable if the IRR is greater than the company’s cost of capital.

D) The internal rate of return (IRR) assumes that cash flows are reinvested at the company’s cost of capital.

[此贴子已经被作者于2008-11-7 18:08:35编辑过]

答案和详解如下!

Question 21

Consider the following graph of a distribution for the prices for various bottles of California-produced wine.

Which of the following statements about this distribution is least accurate?

A) The distribution is positively skewed.

B) Point A represents the mode.

C) Approximately 68% of observations fall within one standard deviation of the mean.

D) The graph could be of the sample $16, $12, $15, $12, $17, $30 (ignore graph scale).

The correct answer was C)

Approximately 68% of observations fall within one standard deviation of the mean.

This statement is true for the normal distribution. The above distribution is positively skewed. Note: for those tempted to use Chebyshev’s inequality to determine the percentage of observations falling within one standard deviation of the mean, the formula is valid only for k > 1.

The other statements are true. When we order the six prices from least to greatest: $12, $12, $15, $16, $17, $30, we observe that the mode (most frequently occurring price) is $12, the median (middle observation) is $15.50 [(15 + 16)/2], and the mean is $17 (sum of all prices divided by number in the sample). Time-Saving Note: Just by ordering the distribution, we can see that it is positively skewed (there are large, positive outliers). By definition, mode < median < mean describes a positively skewed distribution.

This question tested from Session 2, Reading 7, LOS i, (Part 2)

Question 22

The probability of a boom economy is 40%. The probability of Yacht Co. having a 50% return given a boom economy is 80%. The joint probability of a boom economy and a 50% return for Yacht Co. is closest to:

A) 20%.

B) 32%.

C) 40%.

D) 50%.

The correct answer was B ) 32%.

The joint probability of a boom economy and a 50% return for Yacht Co. is 0.40 × 0.80 = 0.32 = 32%.

This question tested from Session 2,

Question 23

Mikal Cosce uses technical analysis to determine his trading behavior. Cosce would be least likely to agree with which of the following statements?

A) He supports the weak form of the efficient market hypothesis.

B) Stock prices move in trends, and these trends persist.

C) Technical analysis tells him when to buy.

D) He does not have to rely on accounting information.

The correct answer was A)

He supports the weak form of the efficient market hypothesis.

The weak form of the efficient market hypothesis (EMH) refutes technical trading. The tests for the weak form of the EMH indicate that after incorporating trading costs, simple trading rules cannot generate positive, consistent, abnormal returns. The other statements are true.

This question tested from Session 3, Reading 12, LOS c

Question 24

Jane Peebles purchased a T-bill that matures in 200 days for $97,500. The face value of the bill is $100,000. The money market yield on the bill is closest to:

A) 4.6%.

B) 4.4%.

C) 4.8%.

D) 5.0%.

The correct answer was A)

4.6%.

Money market yield = holding period yield times (360/days to maturity)

= (100,000 / 97,500 − 1)(360 / 200) = 0.04615 = 4.615%

This question tested from Session 2, Reading 6, LOS d, (Part 2)

Question 25

Which of the following statements about capital-investment decisions is least accurate?

A) Not all projects with a positive net present value (NPV) represent good investments.

B) The NPV is generally considered to be a superior measure of value relative to the IRR.

C) A project is generally considered to be acceptable if the IRR is greater than the company’s cost of capital.

D) The internal rate of return (IRR) assumes that cash flows are reinvested at the company’s cost of capital.

The correct answer was D)

The internal rate of return (IRR) assumes that cash flows are reinvested at the company’s cost of capital.

The IRR assumes that cash flows are reinvested at the IRR. Investors must compare the IRR to the cost of capital to assess whether a project is worthwhile. Some projects with positive but small NPVs may not be good investments. A multiyear investment of $10 million for a $1,000 return would not appeal to most companies. Most analysts would consider NPV to be a superior measure of value when compared with IRR.

This question tested from Session 2, Reading 6, LOS a, (Part 2)

[此贴子已经被作者于2008-5-10 16:30:51编辑过]

谢谢

[em01]thanks

thx

thx

thanks

thx

re

thanks!

很好啊

thanks

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |