Question 41

Which of the following statements about biases that affect the consumer price index (CPI) is least accurate?

A) The net effect of built-in biases in the CPI is to underestimate inflation.

B) Price increases that result from quality improvements are reflected as increases in the CPI.

C) One of the biases that affect the CPI results from newer, more expensive products replacing older, less expensive products.

D) The basket of goods on which the CPI is based becomes a less accurate measure of household costs as consumers substitute among goods.

Question 42

Which statement about marginal revenue product (MRP) is least accurate?

A) The MRP is the addition to total revenue from selling the additional output produced by using one more unit of a productive input.

B) For any productive input, the MRP curve for the input is the firm’s marginal cost curve for the input.

C) The MRP curve is downward sloping in any range of output for which diminishing marginal returns are realized.

D) To maximize profits, a firm will employ additional units of an input until its MRP is equal to its price.

Question 43

A negative real rate of return:

A) indicates that the economy is undergoing recession.

B) is most likely to occur during periods of unexpected erosion of purchasing power.

C) becomes more negative as the rate offered on a risk-free investment increases.

D) is most likely to occur after the Fed has increased reserve requirements.

Question 44

Which of the following statements about the Laffer curve is most accurate?

A) As tax rates increase, tax revenues increase with a multiplier effect.

B) As tax rates decrease, tax revenues decrease at a constant rate.

C) At some point near the middle of the curve tax revenue will be at a minimum.

D) There is a tax rate above which further tax rate increases will decrease tax revenue.

Question 45

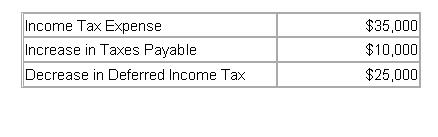

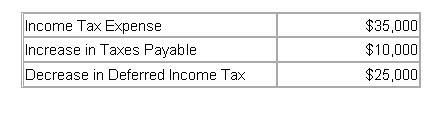

Racquet Company's financial statements show the following information for the year 20X1:

A) $70,000.

B) $50,000.

C) $15,000.

D) $35,000.

[此贴子已经被作者于2008-11-7 18:04:25编辑过]

Question 41

Which of the following statements about biases that affect the consumer price index (CPI) is least accurate?

A) The net effect of built-in biases in the CPI is to underestimate inflation.

B) Price increases that result from quality improvements are reflected as increases in the CPI.

C) One of the biases that affect the CPI results from newer, more expensive products replacing older, less expensive products.

D) The basket of goods on which the CPI is based becomes a less accurate measure of household costs as consumers substitute among goods.

The correct answer was A)

The net effect of built-in biases in the CPI is to underestimate inflation.

The correct answer was A)

The net effect of built-in biases in the CPI is to underestimate inflation.

The CPI is generally believed to overestimate inflation by about 1% per year. Upward biases include quality improvements (price increases due to improving quality do not represent inflation but are reflected in the CPI), new and more expensive goods replacing older and less expensive goods, and commodity substitution (consumers substitute less expensive goods for more expensive ones, rather than continuing to consume a fixed basket of goods).

This question tested from Session 5, Reading 22, LOS d, (Part 4)

Question 42

Which statement about marginal revenue product (MRP) is least accurate?

A) The MRP is the addition to total revenue from selling the additional output produced by using one more unit of a productive input.

B) For any productive input, the MRP curve for the input is the firm’s marginal cost curve for the input.

C) The MRP curve is downward sloping in any range of output for which diminishing marginal returns are realized.

D) To maximize profits, a firm will employ additional units of an input until its MRP is equal to its price.

The correct answer was B) For any productive input, the MRP curve for the input is the firm’s marginal cost curve for the input.

The correct answer was B) For any productive input, the MRP curve for the input is the firm’s marginal cost curve for the input.

For any productive input, the MRP curve is the firm’s short-run demand curve for the productive input. The other statements are accurate.

This question tested from Session 5, Reading 21, LOS a

Question 43

A negative real rate of return:

A) indicates that the economy is undergoing recession.

B) is most likely to occur during periods of unexpected erosion of purchasing power.

C) becomes more negative as the rate offered on a risk-free investment increases.

D) is most likely to occur after the Fed has increased reserve requirements.

The correct answer was B)

The correct answer was B)

is most likely to occur during periods of unexpected erosion of purchasing power.

High unexpected inflation will most likely cause the inflation rate to exceed the nominal rate, which is when real returns are negative.

This question tested from Session 6, Reading 26, LOS d

Question 44

Which of the following statements about the Laffer curve is most accurate?

A) As tax rates increase, tax revenues increase with a multiplier effect.

B) As tax rates decrease, tax revenues decrease at a constant rate.

C) At some point near the middle of the curve tax revenue will be at a minimum.

D) There is a tax rate above which further tax rate increases will decrease tax revenue.

The correct answer was D)

There is a tax rate above which further tax rate increases will decrease tax revenue.

The correct answer was D)

There is a tax rate above which further tax rate increases will decrease tax revenue.

The Laffer curve represents the relation between tax revenues and tax rates. The curve shows that initially, as tax rates increase, tax revenues increase at a decreasing rate. At some tax rate, revenues reach a maximum and any further increase in the tax rate will reduce tax revenues. At higher rates, workers have less incentive to work and the decrease in labor supplied outweighs the effects of the increase in the tax rate.

This question tested from Session 6, Reading 27, LOS a, (Part 2)

Question 45

Racquet Company's financial statements show the following information for the year 20X1:

The cash outflow for income taxes in 20X1 was:

A) $70,000.

B) $50,000.

C) $15,000.

D) $35,000.

The correct answer was B)

The correct answer was B)

$50,000.

Cash income tax payments consist of income tax expense plus the increase in taxes payable less the decrease in deferred income tax.

-$35,000 + $10,000 − $25,000 = -$50,000, or a cash outflow of $50,000.

This question tested from Session 8,

[此贴子已经被作者于2008-5-10 16:50:29编辑过]

good

re

thanks

看看答案

thx

thanks

thx

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |