Question 51

Spenser Inc. is forecasting is future cash flow and market share for the next year. Its market share is expected to remain the same in the future. Which of the following steps should Spenser use in forecasting its future cash flow and sales, respectively?

Forecast of future cash flow Forecast of future sales

A) Start with forecast of future sales Use growth of GDP

B) Start with historical cash flow Use growth of industry sales

C) Start with historical cash flow Use growth of GDP

D) Start with forecast of future sales Use growth of industry sales

Question 52

Lambert Builders, Inc. has begun work on a new post office. In the first year of the project, $2.5 million has been spent out of a reliably estimated total cost of $6.5 million. Total revenue expected for this project is $7 million, and as a government contractor Lambert is reasonably assured of payment. The amount of revenue Lambert should recognize for the year is closest to:

A) $2.5 million.

B) $2.3 million.

C) No revenue should be recognized.

D) $2.7 million.

Question 53

Honeychurch Inc. is an established manufacturing firm that operates in four countries. In analyzing Honeychurch’s income tax disclosures, which of the following items would least likely contribute to a difference between the firm’s reported effective tax rate and the statutory tax rate?

A) Tax differences due to payment of life insurance premiums on key employees.

B) Deferred taxes from using accelerated depreciation for taxes.

C) Different tax rates in different countries in which Honeychurch has income.

D) Tax differences due to interest on tax-free bonds.

Question 54

Undercarriage, Inc.’s cash flow from operations (CFO) in 20X1 was $23 million after Undercarriage paid $16 million in 20X1 to acquire a franchise which it capitalized and amortized over 4 years. Ignoring tax effects, if Undercarriage had expensed the franchise cost in 20X1, CFO in 20X1 would have been:

A) $11 million.

B) $39 million.

C) $7 million.

D) $35 million.

Question 55

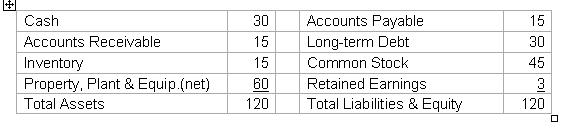

Marcus Corp.’s balance sheet as of December 31 is as follows (in $ millions):

[attach]4295[/attach]

Marcus Corp.’s current ratio and cash ratio are:

Current Ratio Cash Ratio

A) 4 2

B) 3 2

C) 4 3

D) 3 3

[此贴子已经被作者于2008-11-7 18:00:45编辑过]

答案和详解如下!

Question 51

Spenser Inc. is forecasting is future cash flow and market share for the next year. Its market share is expected to remain the same in the future. Which of the following steps should Spenser use in forecasting its future cash flow and sales, respectively?

Forecast of future cash flow Forecast of future sales

A) Start with forecast of future sales Use growth of GDP

B) Start with historical cash flow Use growth of industry sales

C) Start with historical cash flow Use growth of GDP

D) Start with forecast of future sales Use growth of industry sales

The correct answer was D)

Start with forecast of future sales Use growth of industry sales

A forecast of future cash flow (and future net income) often begins at the top of the income statement with a forecast of future sales, not historical cash flow. Then the “top down” approach to forecasting sales begins with a forecast of GDP growth, often supplied by outside research or an in-house economics growth.

With respect to the forecast of future sales specifically, since Spenser’s market share is expected to remain the same, the growth of its sales will be the same as the growth in industry sales for the purposes of forecasting its future sales.

This question tested from Session 10, Reading 42, LOS b

Question 52

Lambert Builders, Inc. has begun work on a new post office. In the first year of the project, $2.5 million has been spent out of a reliably estimated total cost of $6.5 million. Total revenue expected for this project is $7 million, and as a government contractor Lambert is reasonably assured of payment. The amount of revenue Lambert should recognize for the year is closest to:

A) $2.5 million.

B) $2.3 million.

C) No revenue should be recognized.

D) $2.7 million.

The correct answer was D) $2.7 million.

Lambert should use the percentage-of-completion method because the project spans multiple accounting periods and payment is assured. The amount of revenue recognized should be calculated as follows:

This question tested from Session 8,

Question 53

Honeychurch Inc. is an established manufacturing firm that operates in four countries. In analyzing Honeychurch’s income tax disclosures, which of the following items would least likely contribute to a difference between the firm’s reported effective tax rate and the statutory tax rate?

A) Tax differences due to payment of life insurance premiums on key employees.

B) Deferred taxes from using accelerated depreciation for taxes.

C) Different tax rates in different countries in which Honeychurch has income.

D) Tax differences due to interest on tax-free bonds.

The correct answer was B ) Deferred taxes from using accelerated depreciation for taxes

Reported effective tax rate = income tax expense / pretax income. Using accelerated depreciation for taxes and straight-line depreciation for financial statements creates a temporary tax difference will reverse in future years. Since the effect of the temporary differences is already incorporated in the income tax expense calculation (taxes due plus increase in deferred tax liability), there is no difference between the statutory rate and the reported effective rate.

The existence of permanent tax differences (tax credits, tax-exempt income, nondeductible expenses, and tax differences between capital gains and operating income), deferred taxes provided on the reinvested earnings of foreign and unconsolidated domestic affiliates, and different tax rates (or tax holidays) in some foreign jurisdictions could all lead to differences between a firm’s effective tax rate and statutory tax rate.

This question tested from Session 9, Reading 38, LOS h

Question 54

Undercarriage, Inc.’s cash flow from operations (CFO) in 20X1 was $23 million after Undercarriage paid $16 million in 20X1 to acquire a franchise which it capitalized and amortized over 4 years. Ignoring tax effects, if Undercarriage had expensed the franchise cost in 20X1, CFO in 20X1 would have been:

A) $11 million.

B) $39 million.

C) $7 million.

D) $35 million.

The correct answer was C) $7 million.

Capitalization classifies the purchase as a cash outflow from investing, while expensing classifies it as an operating cash outflow. Expensing instead of capitalizing would have shifted the entire outlay of $16 million for the franchise from a reduction in CFI to a reduction in CFO. 20X1 CFO would be $23 − $16 = $7 million.

This question tested from Session 9, Reading 36, LOS a

Question 55

Marcus Corp.’s balance sheet as of December 31 is as follows (in $ millions):

arcus Corp.’s current ratio and cash ratio are:

Current Ratio Cash Ratio

A) 4 2

B) 3 2

C) 4 3

D) 3 3

The correct answer was A ) 4 2

The current ratio, current assets divided by current liabilities, is [(30 + 15 + 15) / 15] = 4.0.

The cash ratio, cash plus marketable securities divided by current liabilities, is (30 + 0) / 15 = 2.0.

This question tested from Session 10, Reading 41, LOS d

[此贴子已经被作者于2008-5-10 17:04:41编辑过]

good!

thanks

thanks

see see, thanks!

thx

thx

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |