1.Consider a semiannual equity swap based on an index at 985 and a fixed rate of 4.4 percent. 90 days after the initiation of the swap, the index is at 982 and LIBOR is 4.6 percent for 90 days and 4.8 percent for 270 days. The value of the swap to the equity payer, based on a $2 million notional value is closest to:

A) -$22,564.

B) $22,314.

C) -$22,314.

D) $22,564.

2.Consider a $5 million semiannual-pay floating-rate equity swap initiated when the equity index is 760 and 180-day LIBOR is 3.7 percent. After 90 days the index is at 767, 90-day LIBOR is 3.4 and 270-day LIBOR is 3.7. What is the value of the swap to the floating-rate payer?

A) $3,526.

B) −$3,526.

C) −$2,726.

D) $2,726.

3.Consider a fixed-rate semiannual-pay equity swap where the equity payments are the total return on a $1 million portfolio and the following information:

§ 180-day LIBOR is 4.2 percent

§ 360-day LIBOR is 4.5 percent

§ Div. yield on the portfolio = 1.2 percent

What is the fixed rate on the swap?

A) 4.3232%.

B) 4.5143%.

C) 4.4477%.

D) 4.4256%.

1.Consider a semiannual equity swap based on an index at 985 and a fixed rate of 4.4 percent. 90 days after the initiation of the swap, the index is at 982 and LIBOR is 4.6 percent for 90 days and 4.8 percent for 270 days. The value of the swap to the equity payer, based on a $2 million notional value is closest to:

A) -$22,564.

B) $22,314.

C) -$22,314.

D) $22,564.

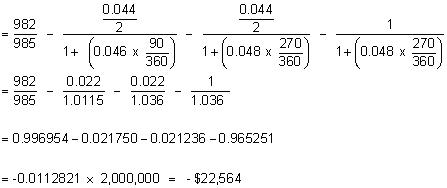

The correct answer was D)

-$22,564 is the value to the fixed-rate payer, so $22,564 is the value to the equity return payer.

2.Consider a $5 million semiannual-pay floating-rate equity swap initiated when the equity index is 760 and 180-day LIBOR is 3.7 percent. After 90 days the index is at 767, 90-day LIBOR is 3.4 and 270-day LIBOR is 3.7. What is the value of the swap to the floating-rate payer?

A) $3,526.

B) −$3,526.

C) −$2,726.

D) $2,726.

The correct answer was B)

1.0185 = 1 + 0.037(180/360)

1.0085 = 1 + 0.034(90/360)

767/760 – 1.0185/1.0085 = −0.00070579 × 5,000,000 = −$3,526

Note: The 1.0185/1.0085 is the present value of the floating rate side after 90 days.

3.Consider a fixed-rate semiannual-pay equity swap where the equity payments are the total return on a $1 million portfolio and the following information:

§ 180-day LIBOR is 4.2 percent

§ 360-day LIBOR is 4.5 percent

§ Div. yield on the portfolio = 1.2 percent

What is the fixed rate on the swap?

A) 4.3232%.

B) 4.5143%.

C) 4.4477%.

D) 4.4256%.

The correct answer was C)

(1 – 1/1.045) / (1/1.021 + 1/1.045) = .022239 × 2 = 4.4477%

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |