Question 76

Which of the following is least likely to be useful to an analyst when estimating the cost of raising capital through the issuance of non-callable, nonconvertible preferred stock?

A) The firm’s corporate tax rate.

B) The preferred stock’s dividend rate.

C) The market price of the preferred stock.

D) The stated par value of the preferred issue.

Question 77

Gerome Masseratti, CFA, and Charles Bataglia are working together to develop pro forma financial statements for one of their firm’s clients. During their initial meeting, Bataglia made a statement with which Masseratti did not agree. Which of the following is most likely the statement that Masseratti objected to?

A) “It is acceptable to forecast future sales using the average compound growth rate of historic sales.”

B) “A firm’s return on equity (ROE) will not necessarily increase just because the firm’s total asset turnover increases.”

C) “If sales are forecast accurately, there is no need to reconcile the pro-forma income statement and balance sheet.”

D) “The original DuPont formula decomposes return on equity (ROE) into three components: net profit margin, total asset turnover, and leverage.”

Question 78

Which of the following actions would most likely have a positive influence on shareholder value?

A) Adopting a poison pill.

B) Only one class of common equity has been issued.

C) Executive board members regularly attend the board meetings.

D) Change from annual elections to elections every three years.

Question 79

Andrew Dawns holds a large position in the common stock of Savory Doughnuts, Inc (Savory). After an extensive executive search, Savory is about to announce a new CEO. There are three candidates for the CEO position, and each is viewed differently by the market. Dawns estimates the following probabilities for the rate of return on Savory’s stock in the year following the announcement:

Candidate | Probability of Being Chosen | Rate of Return if Chosen |

One | .50 | 10% |

Two | .15 | -40% |

Three | .35 | 20% |

Based on Dawn’s estimates, the expected rate of return on Savory’s stock following the announcement of the new CEO is closest to:

A) 6%.

B) -2%.

C) 10%.

D) 9%.

Question 80

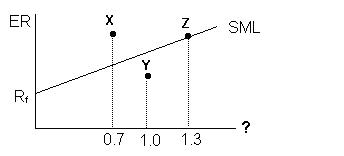

In the graph of the Security Market Line (SML) below (not drawn to scale):

♣ The letters X, Y, and Z represent risky asset portfolios.

♣ The SML crosses the y-axis at 5%.

♣ The market premium is 7.5%.

♣ Portfolio Y and Z have the same expected return (holding period return).

Using the graph and the list of assumptions, determine which of the following statements is most accurate.

A) The expected return on Portfolio Y is 15%.

B) The required return on Portfolio X is 10.25%.

C) The expected return on Portfolio Z is greater than the required return.

D) Portfolio X is overvalued.

答案和详解如下:

Question 76

The correct answer was A) The firm’s corporate tax rate.

The corporate tax rate is not a relevant factor when calculating the cost of preferred stock.

The cost of preferred stock, kps is expressed as: kps = Dps / P

where: Dps = divided per share = dividend rate × stated par value P = market price

This question tested from Session 11, Reading 45, LOS g

Question 77

The correct answer was C) “If sales are forecast accurately, there is no need to reconcile the pro-forma income statement and balance sheet.”

A normal part of constructing pro forma statements is to reconcile the income statement and balance sheet. After the first iteration, there is typically a discrepancy between the total assets account and the total liabilities plus total equity accounts on the firm’s balance sheet. This discrepancy must be resolved through subsequent iterations in the pro forma statement based on assumptions about how a deficit is funded or how a surplus is used.

This question tested from Session 11, Reading 47, LOS b

Question 78

The correct answer was B)

Firms with dual classes of equity can have a negative effect on shareholder value as the shareholder may have inferior voting rights. Takeover measures such as poison pills, golden parachutes, and greenmail typically have a negative effect on shareholder value. Annual elections are preferred for board members as it increases accountability. Executive board members regularly attending the meetings can potentially prevent free discussion among the independent members.

This question tested from Session 11, Reading 48, LOS g

Question 79

The correct answer was A) 6%.

This question tested from Session 12,

Question 80

The correct answer was B) Remember that the SML graph plots systematic, or beta, risk versus expected return. Thus, the numbers on the x-axis represent beta. Using the Capital Asset Pricing Model (CAPM) equation, the required return for portfolio X = Rf + (ERM – Rf) × Beta = 5.0% + 0.7(7.5%) = 10.25%.

Portfolio Y lies below the SML and is thus overvalued and the expected return must be less than the required return. Using the CAPM, required return for portfolio Y = Rf + (ERM – Rf) × Beta = 5.0% + 1.0(7.5%) = 12.50%. (On the exam, you can quickly determine the required return for a portfolio or asset with a beta of 1.0 by adding the risk-free rate and the market premium.) Since the expected return on portfolio Y must be less than the required return, the expected return must be less than 12.50% and cannot be 15%. Since Portfolio Z is on the SML, it is fairly valued and its expected return equals its required return. Since Portfolio X lies above the SML, it is undervalued.

This question tested from Session 12, Reading 51, LOS e

Thanks

good

thx

Thanks

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |