Question 76

Return on equity (ROE) for Stylex Incorporated recently declined from 18% to 16.5%. Which of the following is the most likely explanation for the drop in Stylex’s ROE?

A) An increase in leverage.

B) An increase in total asset turnover.

C) A decrease in revenues.

D) An increase in the effective tax rate.

Question 77

If new equity is issued to finance a capital project, flotation costs will be incurred. Which of the following most accurately describes the impact of flotation costs on the net present value (NPV) analysis of a project if flotation costs are treated correctly? Assuming a firm maintains its target capital structure, if flotation costs are treated correctly:

A) the initial outlay will be higher than if no new equity were issued.

B) the present value of the project’s cash inflows will be higher than if no new equity were issued.

C) the weighted average cost of capital will be higher than if no new equity were issued.

D) the component cost of equity in the weighted average cost of capital will be higher than if no new equity were issued.

Question 78

Which of the following firms is most likely to use a discounted cash flow technique as its primary capital budgeting tool?

A) A large, publicly held European firm that has managers with no formal business education.

B) A small, publicly held

C) A large, publicly held

D) A small, privately held European firm that has managers with no formal business education.

Question 79

Which of the following statements about the security market line (SML) is least accurate?

A) The market portfolio consists of all risky assets.

B) Securities that plot above the SML are undervalued.

C) Securities that plot on the SML have no intrinsic value to the investor.

D) The risk-free rate defines where the SML intersects the vertical axis.

Question 80

If the assumption of zero transactions costs which underlies the derivation of the Security Market Line (SML) is relaxed, the SML:

A) is unique for every investor.

B) is kinked rather than straight.

C) cannot be derived unless a zero-beta portfolio exists.

D) becomes a band rather than a line.

答案和详解如下:

Answer 76

The correct answer was D) An increase in the effective tax rate.

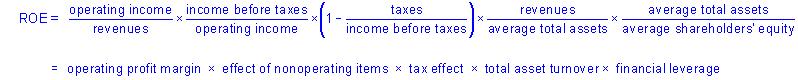

As indicated in the extended DuPont equation presented below, the only factor listed that would decrease ROE is an increase in the tax rate. All of the other choices will cause an increase in ROE.

This question tested from Session 11, Reading 47, LOS a

Answer 77

The correct answer was A)

The correct way to account for flotation costs when performing NPV analysis is to increase the initial cost of the project by the amount of the flotation costs. Flotation costs should not be reflected in the equity component of the weighted average cost (the discount rate) used in NPV analysis because they represent a one time expense that occurs only at the initiation of a project.

This question tested from Session 11, Reading 45, LOS k

Answer 78

The correct answer was C) A large, publicly held

Companies that favor discounted cash flow capital budgeting techniques such as NPV and IRR over payback period or other non-DCF capital budgeting techniques tend to have the following characteristics:

♣ Location: European firms tend to favor payback period.

♣ Size: Smaller firms tend to favor payback period.

♣ Ownership: Private firms tend to favor payback period.

♣ Management education: The more highly educated a firm’s management, the more likely it is to use a DCF capital budgeting technique as its primary tool.

This question tested from Session 11, Reading 44, LOS f

Answer 79

The correct answer was C)

Securities that fall on the SML are properly priced. They have value to an investor in that they still earn a return.

This question tested from Session 12, Reading 51, LOS e

Answer 80

The correct answer was D)

The presence of transactions costs causes the SML to become a band rather than a line because investors will not force slightly overpriced or underpriced securities back to the SML if the expected profit is less than transactions costs. Different SMLs for each investor exist if the assumption of homogeneous risk and return expectations or the assumption of uniform single-period time horizons is relaxed. A zero-beta portfolio can produce a linear SML even if investors cannot borrow or lend unlimited funds at the risk-free rate.

This question tested from Session 12, Reading 51, LOS d, (Part 2)

dacbd

[此贴子已经被作者于2008-11-12 12:11:47编辑过]

谢谢

thanks

thanks

回复

ok

HS

tkx

xx

xxthx

re

3X

db

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |