在一级财务报表分析note的第122页讲到将间接法现金流调整为直接法

这里说在计算cash payment to supplier时要将折旧和摊销加回COGS 为什么呢?折旧和摊销应该是非现金项目啊 请会的朋友解答 谢谢

间接法计算时没有用到COGS啊 是直接从net income开始加回折旧和摊销等非现金项目 再减去accounts receivable等等这些啊

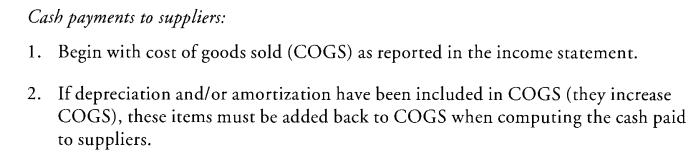

COGS may include certain costs resulting from depreciation and amortization, which are non-cash items.

To adjust from COGS to cash payment to supplier(which is cash-based, not accrual based), the above mentioned expenses should be excluded from the COGS to get the cash payments.

to jgao2003:as you mentioned, depreciation and appreciation should be excluded from COGS to get the cash payment, which is what I think, but note says that depreciatoin and appreciation should be added back to COGS when computing the cash paid to suppliers. I'm confused.~

其实这个很简单,因为COGS在notes上面都是用负号表示的,不知道你发现没有,COGS作为cash paid to supplier的一项来说是要用括号括起或者是前面直接加了个负号的。那么由于depreciation和amortization都是非现金项,如果当时是包括在COGS中的话反而会增加COGS而导致总的COGS不仅包括非现金还包括现金项,负的更大了,那么现在notes上说add back,其实就是把正的加到负的上面,也就是负的COGS加上正的非现金摊销项,那么不就是现金COGS了,而且扣现金COGS更少了,也就会导致paid to supplier可能会减少。

不知道解释清楚了没。

[此贴子已经被作者于2009-4-6 21:07:05编辑过]

谢谢楼上的朋友~ 解释得很清楚

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |