标题: [CFA入门] 2009 Level 1 Mock AM 53题,请教,谢谢 [打印本页]

作者: faye626 时间: 2009-6-5 20:35 标题: 2009 Level 1 Mock AM 53题,请教,谢谢

不明白阿

为什么发行zero-coupon debt的公司的cash from CFO会比发行par bonds的公司要高( 在market rate, maturity date, face value一样的情况下)

谢谢

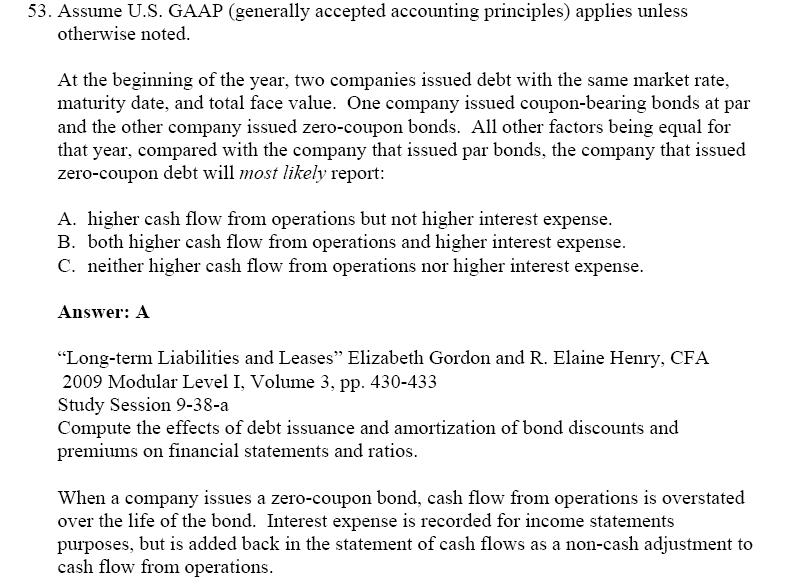

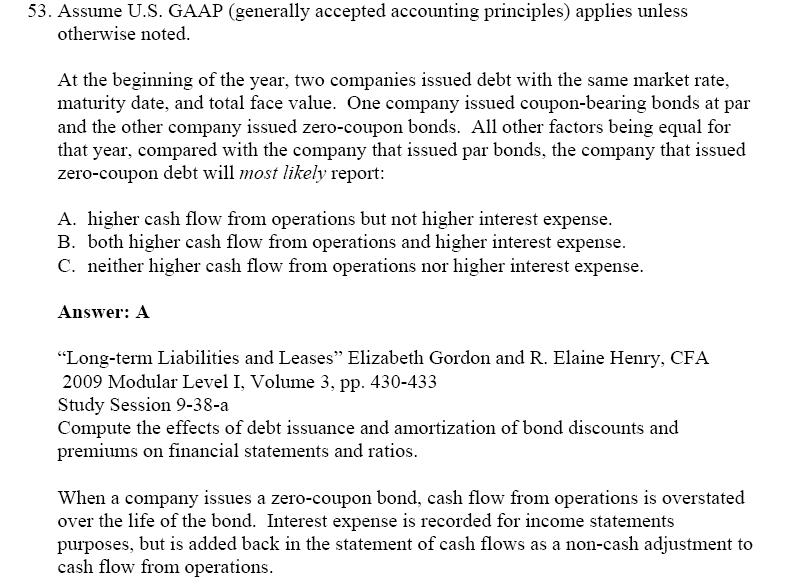

图片附件: 53.jpg (2009-6-5 20:34, 95.03 KB) / 下载次数 0

图片附件: 53.jpg (2009-6-5 20:34, 95.03 KB) / 下载次数 0

http://forum.theanalystspace.com/attachment.php?aid=14192&k=3a87411a6c4a941b7f00cf3bb5ce2272&t=1734793929&sid=o77944

作者: ylwhen 时间: 2009-6-5 21:26

现金流不用支付利息阿

作者: faye626 时间: 2009-6-5 21:40

但是pv就小了吧,要不谁肯买呢,我就想不通

N, I/Y, FV都一样的,一个有PMT一个没有PMT,当然是有PMT的BOND的PV高

作者: pingguohjy 时间: 2009-6-6 02:42

跟pv没关系,是coupon的关系,zero-coupon debt没有coupon payment,就没有operating cash outflow,所以cfo就被高估了

作者: crsby86 时间: 2009-6-6 09:22

let me try may be its a bit late but well

Zero bond has lower price than par bond which means it will has lower interest expense -> eliminates b

operating cash flow = armt - interest payment

zero has no interest so operating cash flow = amrt

par bond = armt - interest payment

thus a is right

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) |

Powered by Discuz! 7.2 |