AIM 3: Explain how the principles of arbitrage pricing of derivatives on fixed income securities can be extended over multiple periods.

1、With respect to interest rate models, backward induction refers to determining:

A) convexity from duration.

B) duration from convexity.

C) one portion of the yield curve from another portion.

D) the current value of a bond based on possible final values of the bond.

The correct answer is D

Backward induction refers to the process of valuing a bond using a binomial interest rate tree. For a bond that has N compounding periods, the current value of the bond is determined by computing the bond’s possible values at period N and working "backwards."

2、A binomial model or any other model that uses the backward induction method cannot be used to value a mortgage-backed security (MBS) because:

A) the cash flows for an MBS only depend on the current rate, not the path that rates have followed.

B) the prepayments occur linearly over the life of an interest rate trend (either up or down).

C) interest rates are irrelevant to the value of a mortgage-backed security.

D) the cash flows for the MBS are dependent upon the path that interest rates follow.

The correct answer is D

A binomial model or any other model that uses the backward induction method cannot be used to value an MBS because the cash flows for the MBS are dependent upon the path that interest rates have followed.

3、A bond with a 10 percent annual coupon will mature in two years at par value. The current one-year spot rate is 8.5 percent. For the second year, the yield volatility model forecasts that the one-year rate will be either eight or nine percent. Using a binomial interest rate tree, what is the current price?

A) 103.572.

B) 101.837.

C) 101.761.

D) 102.659.

The correct answer is D

The tree will have three nodal periods: 0, 1, and 2. The goal is to find the value at node 0. We know the value in nodal period 2: V2=100. In nodal period 1, there will be two possible prices:

V1,U=[(100+10)/1.09+(100+10)/1.09]/2= 100.917

V1,L=[(100+10)/1.08+(100+10)/1.08]/2= 101.852

Thus

V0=[(100.917+10)/1.085+(101.852+10)/1.085]/2= 102.659

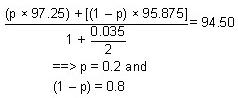

4、A binomial interest-rate tree indicates a 6-month period spot rate of 3.5 percent. The price of the zero-coupon bond if rates decline is 97.25 and if rates increase the bond price is 95.875. If the bond’s market price is 94.5, the risk-neutral probabilities with a decline and increase in rates, respectively, are closest to:

A) 0.1/0.9.

B) 0.9/0.1.

C) 0.2/0.8.

D) 0.8/0.2.

The correct answer is C

5 、Patrick Wall is a new associate at a large international financial institution. His boss, C.D. Johnson, is responsible for familiarizing Wall with the basics of fixed income investing. Johnson asks Wall to evaluate the two otherwise identical bonds shown in Table 1. The callable bond is callable at par and exercisable on the coupon dates only.

Wall is told to evaluate the bonds with respect to duration and convexity when interest rates decline by 50 basis points at all maturities over the next six months.

Johnson supplies Wall with the requisite interest rate tree shown in Figure 1. Johnson explains to Wall that the prices of the bonds in Table 1 were computed using the interest rate lattice. Johnson instructs Wall to try and replicate the information in Table 1 and use his analysis to derive an investment decision for his portfolio.

|

Table 1 | ||

|

|

Non-callable Bond |

Callable Bond |

|

Price |

$100.83 |

$98.79 |

|

Time to Maturity (years) |

5 |

5 |

|

Time to First Call Date |

-- |

0 |

|

Annual Coupon |

$6.25 |

$6.25 |

|

Interest Payment |

Semi-annual |

Semi-annual |

|

Yield to Maturity |

6.0547% |

6.5366% |

|

Price Value per Basis Point |

428.0360 |

-- |

Figure 1.

|

|

|

|

|

|

|

|

|

|

15.44% |

|

|

|

|

|

|

|

|

|

14.10% |

|

|

|

|

|

|

|

|

|

12.69% |

|

12.46% |

|

|

|

|

|

|

|

11.85% |

|

11.38% |

|

|

|

|

|

|

|

9.75% |

|

10.25% |

|

10.05% |

|

|

|

|

|

8.95% |

|

9.57% |

|

9.19% |

|

|

|

|

|

7.91% |

|

7.88% |

|

8.28% |

|

8.11% |

|

|

|

7.35% |

|

7.23% |

|

7.74% |

|

7.42% |

|

|

|

6.62% |

|

6.40% |

|

6.37% |

|

6.69% |

|

6.54% |

|

6.05% |

|

5.95% |

|

5.85% |

|

6.25% |

|

5.99% |

|

|

|

5.36% |

|

5.17% |

|

5.15% |

|

5.40% |

|

5.28% |

|

|

|

4.81% |

|

4.73% |

|

5.05% |

|

4.83% |

|

|

|

|

|

4.18% |

|

4.16% |

|

4.36% |

|

4.26% |

|

|

|

|

|

3.82% |

|

4.08% |

|

3.90% |

|

|

|

|

|

|

|

3.37% |

|

3.52% |

|

3.44% |

|

|

|

|

|

|

|

3.30% |

|

3.15% |

|

|

|

|

|

|

|

|

|

2.84% |

|

2.77% |

|

|

|

|

|

|

|

|

|

2.54% |

|

|

|

|

|

|

|

|

|

|

|

2.24% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years |

0.5 |

1.0 |

1.5 |

2.0 |

2.5 |

3.0 |

3.5 |

4.0 |

4.5 |

Given the following relevant part of the interest rate tree, the value of the callable bond at node A is closest to:

|

|

3.44% |

|

3.15% |

|

|

|

2.77% |

Corresponding part of the callable bond tree:

|

|

|

$100.00 |

|

A ====> |

- |

|

|

|

|

$100.00 |

The value of the bond at node A is closest to:

A) $101.53.

B) $103.56

C) $100.00.

D) $104.60.

The correct answer is C

The value of the callable bond at node A is obtained as follows:

Bond Value = the lesser of the Call Price or {0.5 x [Bond Valueup + Coupon/2] + 0.5 x [Bond Valuedown + Coupon/2]}/(1+ Interest Rate/2)]

So we have

Bond Value at node A = the lesser of either $100 or {0.5 x [$100.00 + $6.25/2] + 0.5 x [$100.00+ $6.25/2]}/(1+ 3.15%/2) = $101.52. Since the call price of $100 is less than the computed value of $101.52 the bond price would be $100 because once the price of the bond reached this value it would be called.

6、Which of the following is the appropriate "nodal decision" within the backward induction methodology of the interest tree framework for a callable bond?

A) Max(call price, discounted value).

B) Max(par value, discounted value).

C) Min(par value, discounted value).

D) Min(call price, discounted value).

The correct answer is D

When valuing a callable bond using the backward induction methodology, the relevant cash flow to use at each nodal period is the coupon to be received during that nodal period plus the computed value or the call price, whichever is less.

7、A callable bond with an 8.2 percent annual coupon will mature in two years at par value. The current one-year spot rate is 7.9 percent. For the second year, the yield-volatility model forecasts that the one-year rate will be either 6.8 or 7.6 percent. The call price is 101. Using a binomial interest rate tree, what is the current price?

A) 101.140.

B) 100.558.

C) 100.279.

D) 99.759.

The correct answer is A

The tree will have three nodal periods: 0, 1, and 2. The goal is to find the value at node 0. We know the value for all the nodes in nodal period 2: V2=100. In nodal period 1, there will be two possible prices:

V1,U =[(100+8.2)/1.076+(100+8.2)/1.076]/2 = 100.558

V1,L =[(100+8.2)/1.068+(100+8.2)/1.068]/2= 101.311

Since V1,L is greater than the call price, the call price is entered into the formula below:

V0=[(100.558+8.2)/1.079)+(101.311+8.2)/1.079)]/2 = (100.795 + 101.493) / 2 = 101.14.

8、Suppose that the value of an option-free bond is equal to 100.16, the value of the corresponding callable bond is equal to 99.42, and the value of the corresponding putable bond is 101.72. What is the value of the call option?

A) 0.74.

B) 0.21.

C) 0.64.

D) 1.56.

The correct answer is A

The call option value is just the difference between the value of the option-free bond and the value of the callable bond. Therefore, we have:

Call option value = 100.16 – 99.42 = 0.74.

9、Which of the following is a correct statement concerning the backward induction technique used within the binomial interest rate tree framework? From the maturity date of a bond:

A) a deterministic interest rate path is used to discount the value of the bond.

B) the corresponding interest rates are weighted by the bond's duration to discount the value of the bond.

C) the corresponding interest rates are adjusted for the bond's convexity to discount the value of the bond.

D) the corresponding interest rates and interest rate probabilities are used to discount the value of the bond.

The correct answer is D

For a bond that has N compounding periods, the current value of the bond is determined by computing the bond’s possible values at period N and working “backwards” to the present. The value at any given node is the probability-weighted average of the discounted values of the next period’s nodal values.

10、Why is the backward induction methodology used to value a bond rather than a forward induction scheme?

A) The convexity of a bond changes over time.

B) The price of the bond is known at maturity.

C) Future interest rate changes are difficult to forecast.

D) The mathematical properties of a forward difference scheme are not tractable.

The correct answer is B

The objective is to value a bond's current price while the bond price at maturity is known. Therefore, price at maturity is used as a starting point, and we work backward to the current value.

11、Using the following interest rate tree of semiannual interest rates what is the value of an option free semiannual bond that has one year remaining to maturity and has a 6 percent coupon rate?

6.53%

6.30%

5.67%

A) 97.53.

B) 99.81.

C) 98.52.

D) 100.16.

The correct answer is B

The option-free bond price tree is as follows:

100.00

A ==> 99.74

99.81 100.00

100.16

100.00

As an example, the price at node A is obtained as follows:

PriceA = (prob * (Pup + coupon/2) + prob * (Pdown + coupon/2))/(1 + rate/2) = (0.5 * (100 + 3) + 0.5 * (100 + 3))/(1 + 0.0653/2) = 99.74. The bond values at the other nodes are obtained in the same way.

The calculation for node 0 or time 0 is

0.5[(99.74 + 3)/(1+ .063/2) + (100.16 + 3)/(1 + .063/2)] =

0.5 (99.60252 + 100.00969) = 99.80611

AIM 7: Explain the impact of embedded options on a fixed-income security’s price.

1、Mortgages are subject to prepayment when interest rates fall. This results in duration extending when interest rates rise, but shortening when interest rates fall. This characteristic is called:

A) positive convexity.

B) negative duration.

C) negative convexity.

D) reverse duration.

The correct answer is C

An instrument that declines more in value when interest rates rise than it increases when interest rates fall is said to have negative convexity. Mortgage-backed securities have this characteristic because of the mortgagor’s option to prepay.

2、With respect to bond investing, reinvestment risk is a very important component of what other type of risk?

A) Default risk.

B) Liquidity risk.

C) Call risk.

D) Downgrade risk.

The correct answer is C

Call risk is composed of three components: the unpredictability of the cash flows, the compression of the bond’s price, and the high probability that when the bond is called the investor will be faced with less attractive investment opportunities. This latter risk is reinvestment risk. Reinvestment risk is not a directly related to any of the other choices.

3、If a put feature expires on a bond so that it becomes option-free, then the curve depicting the price and yield relationship of the bond will become:

A) more convex.

B) a straight line.

C) less convex.

D) inversely convex.

The correct answer is C

When the option expires, the prices at the lower end of the curve will become lower. This will make the curve less convex.

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |