Question 61

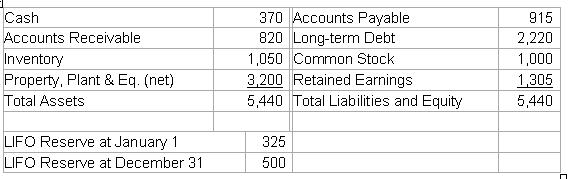

Selected information from Hometown, Inc.’s financial statements for the year ended December 31 included the following (in $ thousands):

Hometown used the last in, first out (LIFO) inventory cost flow assumption. If Hometown changed from LIFO to first in, first out (FIFO), its current ratio would:

A) increase to 2.63.

B) be unchanged.

C) decrease to 1.50.

D) increase to 2.99.

Question 62

The calculation of ratios would be best classified under which of the following steps in the financial statement analysis framework?

A) Process the data.

B) Gather the data.

C) Analyze the data.

D) Interpret the data.

Question 63

Granite, Inc. owns a machine with a carrying value of $3.0 million, a salvage value of $2 million, and a present value of future cash flows of $1.7 million. The asset is permanently impaired. Granite should:

A) immediately write down the machine to its salvage value.

B) immediately write down the machine to its present value of future cash flows.

C) write down the machine to its present value of future cash flows as soon as it is depreciated down to salvage value.

D) not write down the machine's value until it is sold or removed from service.

Question 64

Schachter Inc. has issued a bond at par that can be called prior to maturity at 102% of face value. Since the issuance of the bond, interest rates have fallen such that the present (market) value of the bond’s future cash flows has risen to 106% of face value. Using only this information, which of the following accounting and economic impacts of calling the bond are most appropriate, respectively?

Accounting treatment Economic impact

A) Loss Gain

B) Loss Loss

C) Gain Gain

D) Gain Loss

Question 65

Which of the following measurements bases for property, plant, and equipment would a successful manufacturing firm be most likely to use for financial statement reporting?

A) Fair value.

B) Standard cost.

C) Net realizable value.

D) Historical cost.

[此贴子已经被作者于2008-11-7 17:59:02编辑过]

答案和详解如下!

Question 61

Selected information from Hometown, Inc.’s financial statements for the year ended December 31 included the following (in $ thousands):

Hometown used the last in, first out (LIFO) inventory cost flow assumption. If Hometown changed from LIFO to first in, first out (FIFO), its current ratio would:

A) increase to 2.63.

B) be unchanged.

C) decrease to 1.50.

D) increase to 2.99.

The correct answer was D) increase to 2.99.

Hometown’s current ratio under LIFO is ($370 + $820 + $1,050) / $915 = 2.45. To convert LIFO to FIFO, increase inventory by the ending LIFO reserve balance: ($1,050 + $500 =) $1,550. The current ratio under FIFO would be ($370 + $820 + $1,550) / $915 = 2.99.

This question tested from Session 9, Reading 35, LOS d

Question 62

The calculation of ratios would be best classified under which of the following steps in the financial statement analysis framework?

A) Process the data.

B) Gather the data.

C) Analyze the data.

D) Interpret the data.

The correct answer was A) Process the data.

Calculating ratios is best classified under “process the data” because it is the first step in transforming the raw data into useful information. For example, the calculation of a useful measure of liquidity, the current ratio, requires gathering data on current assets (i.e. cash, accounts receivable, and inventory) and current liabilities prior to performing the calculation.

Gathering data occurs prior to performing calculations on such data. Analyzing and interpreting the data go together and use the information from the ratio calculations to make meaningful conclusions and recommendations. The analysis and interpretation occur after the data has been processed.

This question tested from Session 7, Reading 29, LOS f

Question 63

Granite, Inc. owns a machine with a carrying value of $3.0 million, a salvage value of $2 million, and a present value of future cash flows of $1.7 million. The asset is permanently impaired. Granite should:

A) immediately write down the machine to its salvage value.

B) immediately write down the machine to its present value of future cash flows.

C) write down the machine to its present value of future cash flows as soon as it is depreciated down to salvage value.

D) not write down the machine's value until it is sold or removed from service.

The correct answer was B)

immediately write down the machine to its present value of future cash flows.

When an asset is permanently impaired, it must be written down to the present value of its future cash flows in the period in which the impairment is recognized.

This question tested from Session 9, Reading 37, LOS d

Question 64

Schachter Inc. has issued a bond at par that can be called prior to maturity at 102% of face value. Since the issuance of the bond, interest rates have fallen such that the present (market) value of the bond’s future cash flows has risen to 106% of face value. Using only this information, which of the following accounting and economic impacts of calling the bond are most appropriate, respectively?

Accounting treatment Economic impact

A) Loss Gain

B) Loss Loss

C) Gain Gain

D) Gain Loss

The correct answer was A) Loss Gain

From an accounting standpoint, a loss is recorded since the redemption price of 102 is greater than the book value of 100 (since it was issued at par). If interest rates have fallen such that the present value of the bond liability is 106% of face value, then retiring it at 102% of face value generates an economic gain for Schachter.

This question tested from Session 9, Reading 39, LOS g

Question 65

Which of the following measurements bases for property, plant, and equipment would a successful manufacturing firm be most likely to use for financial statement reporting?

A) Fair value.

B) Standard cost.

C) Net realizable value.

D) Historical cost.

The correct answer was D) Historical cost.

Property, plant and equipment is an example of a tangible asset (long-term asset with physical substance). It is reported on the balance sheet at historical cost less accumulated depreciation. Historical cost includes the original cost of the asset plus all costs necessary to get the asset ready for use (e.g. freight and installation).

General use financial statements for external parties do not permit the use of fair value reporting for tangible assets. Net realizable value is more commonly used with inventory. When applied to tangible assets, it is used when there is no longer the assumption of a going concern (continued existence) for the firm. Since the firm is successful, it is reasonable to assume the firm will remain a going concern and so net realizable value would not be an appropriate measure for financial statement reporting purposes. Standard costing is often used by manufacturing firms in order to assign predetermined costs to a large number of homogeneous goods produced. It is irrelevant for financial statement reporting purposes.

This question tested from Session 8, Reading 33, LOS e

[此贴子已经被作者于2008-5-10 17:53:46编辑过]

thanks a lot!!!

THX

re

thanks

thanks

thx

[em01]

thx

thanks

thanks| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |