标题: CFA Level 1 - 模考试题(1)(PM) Q77-78 [打印本页]

作者: sunlimei 时间: 2008-5-10 15:45 标题: 2008 CFA Level 1 - 模考试题(1)(PM) Q77-78

Question 77

When evaluating the qualifications of a board member, which of the following is least likely to be considered a positive factor? The board member:

A) has board membership in excess of 10 years.

B) regularly attends meetings.

C) has made public statements regarding his ethical positions.

D) has experience on other boards.

Question 78

Which of the following is most accurate regarding the component costs and component weights in a firm’s weighted average cost of capital (WACC)?

A) The dividend exclusion for corporate investments in preferred stock reduces the after-tax cost of preferred stock.

B) The weights in the WACC should be based on the book values of the individual capital components.

C) The appropriate pre-tax cost of a firm’s new debt is the average coupon rate on the firm’s existing debt.

D) Taxes reduce the cost of debt for firms in countries in which interest payments are tax deductible.

[此贴子已经被作者于2008-11-8 9:41:23编辑过]

作者: sunlimei 时间: 2008-5-10 15:47

答案和详解如下!

Question 77

When evaluating the qualifications of a board member, which of the following is least likely to be considered a positive factor? The board member:

A) has board membership in excess of 10 years.

B) regularly attends meetings.

C) has made public statements regarding his ethical positions.

D) has experience on other boards.

The correct answer was A) has board membership in excess of 10 years.

While board membership in excess of 10 years may add experience, it also may indicate a board member who has developed an unhealthy alliance with management.

This question tested from Session 11, Reading 48, LOS d

Question 78

Which of the following is most accurate regarding the component costs and component weights in a firm’s weighted average cost of capital (WACC)?

A) The dividend exclusion for corporate investments in preferred stock reduces the after-tax cost of preferred stock.

B) The weights in the WACC should be based on the book values of the individual capital components.

C) The appropriate pre-tax cost of a firm’s new debt is the average coupon rate on the firm’s existing debt.

D) Taxes reduce the cost of debt for firms in countries in which interest payments are tax deductible.

The correct answer was D) Taxes reduce the cost of debt for firms in countries in which interest payments are tax deductible.

The after-tax cost of debt = kd(1 – t) = kd – kd(t), where kd is the pretax cost of debt and t is the effective corporate tax rate. So the tax savings from the tax treatment of debt is kd(t). The dividend exclusion for corporate holders of preferred stock may be beneficial to the investing firm, not the issuing firm. Capital component weights should be based on market weights, not book values. And, the appropriate pre-tax cost of debt is the yield to maturity on the firm’s existing debt.

This question tested from Session 11, Reading 45, LOS f

作者: sunlimei 时间: 2008-5-10 15:51 标题: 2008 CFA Level 1 - Exam 1 (PM)Q79

Question 79

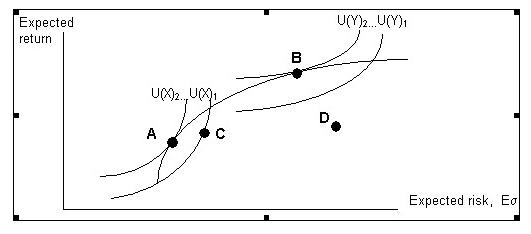

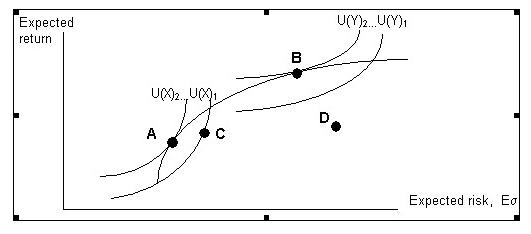

The graph below combines the efficient frontier with the indifference curves for two different investors, X and Y (represented by U(X) and U(Y)). The letters A, B, C, and D represent four

Which of the following statements about the above graph is most accurate?

A) Investor X would be better off moving to indifference curve U(X)1 and Portfolio C because of the higher return on that portfolio.

B) Investor X is less risk-averse than Investor Y.

C) The backward bend in the efficient frontier is due to less than perfect correlation between portfolio assets.

D) Portfolio B is an optimal portfolio, Portfolio A is suboptimal.

Which of the following statements about the above graph is most accurate?

A) Investor X would be better off moving to indifference curve U(X)1 and Portfolio C because of the higher return on that portfolio.

B) Investor X is less risk-averse than Investor Y.

C) The backward bend in the efficient frontier is due to less than perfect correlation between portfolio assets.

D) Portfolio B is an optimal portfolio, Portfolio A is suboptimal.

[此贴子已经被作者于2008-5-10 15:51:51编辑过]

图片附件: [2008 CFA Level 1 - Exam 1 (PM)Q77-78] 未命名.jpg (2008-5-10 15:50, 14.23 KB) / 下载次数 0

图片附件: [2008 CFA Level 1 - Exam 1 (PM)Q77-78] 未命名.jpg (2008-5-10 15:50, 14.23 KB) / 下载次数 0

http://forum.theanalystspace.com/attachment.php?aid=4282&k=5af5b53cd79a6469b1db48e6b90d2078&t=1766226657&sid=BMid22

作者: wemhugh 时间: 2008-5-11 18:10

thanks

作者: wj_cathy 时间: 2008-5-12 13:13

ds

作者: road234 时间: 2008-5-12 17:13

啊

作者: vivian630 时间: 2008-5-13 15:39

ThanQ

作者: wlzh0202 时间: 2008-5-13 21:40

3x!

作者: snoopy55 时间: 2008-5-15 16:50

good

作者: edisonzpz 时间: 2008-5-16 00:54

[em02]

作者: gdtoknw 时间: 2008-5-16 04:46 标题: yea

yea

作者: no3no4 时间: 2008-5-17 21:00

[em01]

作者: leslieyuan 时间: 2008-5-17 21:31 标题: good man

good

作者: fyy8433 时间: 2008-5-19 16:10

SEE

作者: toheaven 时间: 2008-5-22 23:44

[em02]

作者: bmwbmwbmw 时间: 2008-5-25 11:08

thx

作者: Nelsonla 时间: 2008-5-25 18:49

thanks

作者: mikerw 时间: 2008-5-25 20:05

3x

作者: fatiger 时间: 2008-5-26 09:57

qq

作者: hutty2000 时间: 2008-5-26 10:07

11

作者: camelhe 时间: 2008-5-26 19:59

guo fen

作者: luyuansz 时间: 2008-5-26 20:25

[em01]

作者: allworld12 时间: 2008-5-27 02:10

good

作者: zhuce 时间: 2008-5-27 03:45

thx

作者: leeyaoxee 时间: 2008-5-27 05:59 标题: 回复:(sunlimei)2008 CFA Level 1 - Exam 1 (PM)...

thx

作者: jasperdong 时间: 2008-5-27 09:24

thanks

作者: kikicocoyy 时间: 2008-5-27 10:15

fsd

作者: kikicocoyy 时间: 2008-5-27 10:16

fsd

作者: wendycfa 时间: 2008-5-27 10:31

3x

作者: aoze1 时间: 2008-5-28 05:54

a

作者: 刀剑如梦 时间: 2008-5-28 11:55

非常感谢

作者: 刀剑如梦 时间: 2008-5-28 11:55

非常感谢

作者: allanwang 时间: 2008-5-28 12:47

thanks1[em02]

作者: twinklelee 时间: 2008-5-28 12:55

thanks!

作者: doggydaddy 时间: 2008-5-28 20:16

[em06]

作者: qiumo 时间: 2008-5-28 21:10

thx

作者: sweeter 时间: 2008-5-29 01:06

kk

作者: lovetiky 时间: 2008-5-29 09:22

thanks

作者: smalldong 时间: 2008-5-29 17:42

j

作者: smalldong 时间: 2008-5-29 17:46

h

作者: bingliang 时间: 2008-5-29 20:33 标题: 3x

3x

作者: CFAZTY 时间: 2008-5-30 18:58

[em01]

作者: Riverview 时间: 2008-5-31 01:26

thanks

作者: 1234567111 时间: 2008-5-31 05:09

merci

作者: fionayan 时间: 2008-5-31 10:46

thx

作者: blwh 时间: 2008-5-31 11:58

x

作者: tannyyu 时间: 2008-5-31 12:08

ejhwtlakerw

作者: gening 时间: 2008-5-31 15:03 标题: thanks!

thanks!

作者: gosnoopy 时间: 2008-5-31 16:20

cc

作者: cmoslj 时间: 2008-6-1 13:52

thx

作者: isaisaisa 时间: 2008-6-2 00:41

thx

作者: oleander 时间: 2008-6-2 04:23

cd

作者: ks0606 时间: 2008-6-2 13:14

dd

作者: cindyxin 时间: 2008-6-2 21:57

re

作者: 枫叶飘零 时间: 2008-6-3 02:54

thankx

作者: gmdr 时间: 2008-6-3 03:19

d

作者: JeNnaQ 时间: 2008-6-3 16:48

[em02]

作者: repitile 时间: 2008-6-3 23:03

ree

作者: fight4cfa 时间: 2008-6-4 00:33

A

作者: weinei 时间: 2008-6-5 13:37

THANKS!

作者: firstwl 时间: 2008-6-5 16:23

gf

作者: Anex 时间: 2008-6-5 16:39

thank you so much

作者: skarlin 时间: 2008-6-5 20:21

CC[em01]

作者: justang 时间: 2008-6-5 22:22

看看答案

作者: abowang 时间: 2008-6-5 23:23

ThANKS A LOT

作者: xieyingzi 时间: 2008-6-6 11:04

UPUPUPUPU

作者: wtf2002 时间: 2008-6-6 13:59

ding

作者: rossxue 时间: 2008-6-6 17:10 标题: 我晕头转向

我云层

作者: zhuyifan 时间: 2008-6-6 22:49

Thanks!

作者: treachu 时间: 2008-6-7 01:44

thx

作者: camilleZ 时间: 2008-6-7 05:18

[em02]

作者: txw999 时间: 2008-6-7 09:30

xie

作者: hptaoing 时间: 2008-6-11 20:31

[em01]

作者: liu0007 时间: 2008-6-12 10:13

咋整的?

作者: gickistar 时间: 2008-6-12 17:49

thx

作者: clairey 时间: 2008-6-15 19:11

Thanks for sharing!!!

作者: vivivin 时间: 2008-6-19 11:40

thx

作者: lucylu 时间: 2008-8-1 13:41

作者: monica0419 时间: 2008-8-11 13:08

看答案,谢谢

作者: yangweili 时间: 2008-8-11 18:22

thanks

作者: jinsha 时间: 2008-8-21 16:39

thanks

作者: molwegw 时间: 2008-8-22 18:31

thx

作者: maplekang 时间: 2008-8-23 19:17

thx

作者: lxitb 时间: 2008-8-24 00:58

thanks

作者: cia801027 时间: 2008-8-26 09:14

asd

作者: 小candy 时间: 2008-9-26 10:19

thx

作者: liuq1596 时间: 2008-9-26 14:40 标题: d

d

作者: fioncy 时间: 2008-10-6 00:51

DING

作者: zerowqm 时间: 2008-10-6 11:33

222[em05]

作者: liyi2010 时间: 2008-10-6 11:41

[em01]

作者: zerowqm 时间: 2008-10-7 10:25

a[em04]

作者: elea0930 时间: 2008-10-7 15:55

aa

作者: xelloss711 时间: 2008-10-10 08:37

thanks

作者: stanleymyc 时间: 2008-10-11 21:17

ding

作者: birred 时间: 2008-10-15 19:38

re

作者: myguitar33 时间: 2008-10-16 09:40

good

作者: godmary 时间: 2008-10-16 11:47

[em05]

作者: martain_M 时间: 2008-11-2 20:06

thanks

作者: crimsonefr 时间: 2008-11-3 13:45

thx[em01]

作者: xujunzhe22 时间: 2008-11-3 18:12

3x

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) |

Powered by Discuz! 7.2 |