标题: 2008 CFA Level 1 - Sample 样题(1)-Q37 [打印本页]

作者: 8586 时间: 2008-5-19 14:00 标题: 2008 CFA Level 1 - Sample 样题(1)-Q37

37、Oxford Enterprises Incorporated is determining the cost of debt to use in its weighted average cost of capital. It has recently issued a 10-year, 6 percent semi-annual coupon bond for $864. The bond has a maturity value of $1,000. If the marginal tax rate is 35 percent, the cost of debt they should use in their calculation is closest to:

A. 2.6%.

B. 3.9%.

C. 5.2%.

D. 6.0%.

[此贴子已经被作者于2008-11-7 15:55:13编辑过]

作者: 8586 时间: 2008-5-19 14:03 标题: 答案和详解回复可见:

Correct answer = C

"Cost of Capital," Yves Courtois, Gene C. Lai, and Pamela P. Peterson

2008 Modular Level I, Vol. 4, pp. 45-46

Study Session 11-45-b, f

describe how taxes affect the cost of capital from different capital sources;

calculate and interpret the cost of fixed-rate debt capital using the yield-to-maturity approach and the debt-rating approach

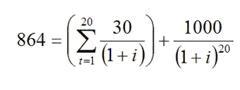

The cost of debt to be used in the weighted average cost of capital (WACC) would be the yield-to-maturity after tax. Coupon payment = 0.06 / 2 x 1,000 = 30. To obtain the pre-tax yield to maturity, solve the following equation for i:

i = 4% per period, or 8% per year. After-tax cost of debt = 8 x (1 - 0.35) = 5.2%

FV = 1,000; PV = -864; PMT = 30; N = 20. Compute I / Y. I / Y = 4% semi-annual.

Annual = 4 x 2 = 8%. After-tax cost of debt = 8 x (1 - 0.35) = 5.2%

[此贴子已经被作者于2008-5-19 14:04:08编辑过]

图片附件: [[2008 CFA level 1模拟真题]Version 1 Questions-Q37] 44.jpg (2008-5-19 14:02, 3.78 KB) / 下载次数 0

图片附件: [[2008 CFA level 1模拟真题]Version 1 Questions-Q37] 44.jpg (2008-5-19 14:02, 3.78 KB) / 下载次数 0

http://forum.theanalystspace.com/attachment.php?aid=4357&k=302ff1d981e2ff82f3362e7ec76fb9b2&t=1763666088&sid=3r7Do4

作者: cxz0858 时间: 2008-5-19 21:29

以下内容只有回复后才可以浏览

作者: louzhuqued 时间: 2008-5-22 22:44

t

作者: zhangxie83 时间: 2008-5-27 04:56

b

作者: jasperdong 时间: 2008-5-27 10:09

thanks

作者: smalldong 时间: 2008-5-28 22:35

a

作者: Riverview 时间: 2008-5-30 07:37

thanks

作者: 刀剑如梦 时间: 2008-5-31 13:21

谢谢哦!

作者: gening 时间: 2008-6-1 05:51 标题: thanks!

thanks!

作者: 盛夏的果实 时间: 2008-6-1 17:22

thanks

作者: isaisaisa 时间: 2008-6-2 17:43

thx

作者: oleander 时间: 2008-6-3 05:35

c

作者: clover 时间: 2008-6-5 17:07

a

作者: tannyyu 时间: 2008-6-6 16:09

dsfadf

作者: lucylu 时间: 2008-8-1 15:50

thanks

作者: zhuce 时间: 2008-9-19 04:07

thanks

作者: 小candy 时间: 2008-9-26 15:46

thx

作者: AtTRV2008 时间: 2008-9-27 10:04

Thanks!

作者: elea0930 时间: 2008-10-1 20:33

b

作者: myguitar33 时间: 2008-10-20 12:39

good

作者: leo1979 时间: 2008-10-30 16:43

thx

作者: slkly 时间: 2008-11-14 09:11

[em01][em02][em03]

作者: aleko953 时间: 2008-11-23 19:38

1

作者: cuckoozj 时间: 2008-12-1 06:31 标题: 回复:(8586)2008 CFA Level 1 - Sample 样题(1)-...

回复

作者: jzhang21 时间: 2008-12-3 04:11

xie xie

作者: xkgenius 时间: 2008-12-4 15:31

3x

作者: snowchild30 时间: 2009-5-6 22:24

好

作者: kidd 时间: 2009-5-7 00:06

cat

作者: percy 时间: 2009-5-7 09:21

c

作者: CFAcanada 时间: 2010-2-7 08:04

tx

作者: xxjj564 时间: 2011-3-4 09:35

a

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) |

Powered by Discuz! 7.2 |