Note that you could save yourself some time on the exam by not calculating after-tax interest expense and FCFF as part of the response to this question and not going out to Year 6. We did it here for comprehensiveness in creating the table.

Question 5

Flores Media Corp. is a Spanish-language radio, television, and print media conglomerate with principal offices in

Depreciation in the upcoming year is expected to reach $4.00 per share, and grow along with revenue. Net fixed capital investment is budgeted at $1.00 per share in each year as part of the firm’s expansion program, until Year 6 when it is projected to begin growing in line with revenue. Working capital investment is anticipated to be $1.50 per share in the upcoming year, growing in line with revenue.

The firm has no preferred stock and only $250 million in long-term debt, which pays 12 percent and trades at par. In view of the firm’s 40 percent tax rate, the debt burden is miniscule. Even so, Jimenez expects to keep the growth in interest expense to only 10 percent per year through restructuring and refinancing until Year 6, when growth in interest expense should equal the growth in sales. The firm does not plan to finance its expansion with any new debt.

Bradshaw would target a 20 percent weighted average cost of capital for Flores during its rapid growth phase, but thinks the figure should come down to a more modest 14 percent in the stable growth phase. Based on his calculations, Bradshaw tells Jimenez, “We’ve done our due diligence, and based on our numbers, $18 per share is a fair price for your interest in Flores Media.” Jimenez counters that, using Bradshaw’s own numbers, the value of the firm exceeds $45 per share.

They suspend negotiations for the evening.

Part 1)

Bradshaw decides to calculate free cash flow to the firm (FCFF) startng with net income. Which statement regarding how to derive free cash flow to the firm (FCFF) from net income is least accurate?

A) Subtract fixed capital investment.

B) Add amortization of intangibles.

C) Add working capital investment.

D) Add interest expense adjusted for taxes.

Part 2)

What is free cash flow to equity (FCFE) per share in Year 5?

A) $6.99.

B) $6.11.

C) $4.35.

D) $8.75.

Part 3)

Which value is closest to the percentage growth in FCFF in Year 4?

A) 22%.

B) 15%.

C) 32%.

D) 20%.

Part 4)

If the growth rate of FCFF were 7 percent beginning in year 6 rather than 5 percent, how much would that add to the value that Bradshaw should be willing to pay for

A) $24.44.

B) $12.69.

C) $9.82.

D) $110.00.

Part 5)

Regarding the statements made by Bradshaw and Jimenez about the per share value of Flores Media:

A) Bradshaw’s statement is correct; Jimenez’s statement is correct.

B) Bradshaw’s statement is incorrect; Jimenez’s statement is correct.

C) Bradshaw’s statement is correct; Jimenez’s statement is incorrect.

D) Bradshaw’s statement is incorrect; Jimenez’s statement is incorrect.

Part 6)

If Jimenez and Bradshaw agreed to calculate the terminal value of the Flores Media using the median industry forward P/E of 12 instead of a discounted cash flow method, what impact would that have on the price that Bradshaw should be willing to pay for Flores?

A) A decrease of $22.08.

B) An increase of $7.42.

C) An increase of $22.08.

D) An increase of $8.87.

Part 1)

Bradshaw decides to calculate free cash flow to the firm (FCFF) startng with net income. Which statement regarding how to derive free cash flow to the firm (FCFF) from net income is least accurate?

A) Subtract fixed capital investment.

B) Add amortization of intangibles.

C) Add working capital investment.

D) Add interest expense adjusted for taxes.

The correct answer was C) Add working capital investment.

The formula for calculating cash flow to the firm (FCFF) from net income is:

FCFF = Net income + Noncash charges + [Interest expense × (1 – tax rate)] – fixed capital investment – working capital investment

We need to make four crucial adjustments to net income in order to get FCFF:

This question tested from Session 12, Reading 47, LOS k

Part 2)

What is free cash flow to equity (FCFE) per share in Year 5?

A) $6.99.

B) $6.11.

C) $4.35.

D) $8.75.

The correct answer was C) $4.35.

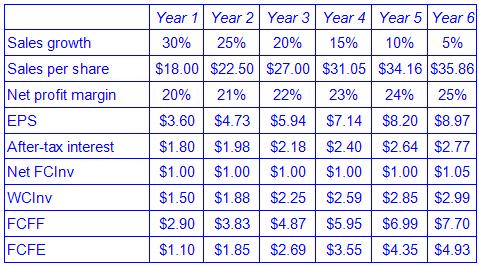

We start by creating the table below:

We know that sales growth is going to slow linearly from 30% in Year 1 to 5% in Year 6. We also know that next year’s net income is expected to be $3.60 given a 20% net profit margin, so sales per share must be $18.00. Using $18.00 per share as the Year 1 value we can forecast sales per share for Years 2 - 6. We also know that the net profit margin of 20% in Year 1 is increasing in equal increments until it hits 25% in Year 6. With that information, we can calculate net profit margin and net income for Year 2 - 6.

We know that the firm has ($250 million / 10 million shares = ) $25 per share of debt outstanding, which pays 12% and trades at par. Thus, interest expense must be ($25 x 0.12 = ) $3.00 per share pre-tax and ($3.00 x (1 – 0.40) = ) $1.80 after-tax, growing at 10% per year until Year 6, when it hits 5%. We also know that Net FCInv in Year 1 is always $1.00 per share until Year 6, when it begins growing in line with revenue. Note that you can save a step in the calculation of FCFF if you recognize that you don’t need to know depreciation if you know net FCInv. Finally, we know that WCInv is $1.50 per share, growing at the same rate as revenue.

Having calculated this, we can calculate:

FCFF = Net Income + After-tax interest – net FCInv – WCInv

FCFE = Net Income – net FCInv - WCInv

Note that you could save yourself some time on the exam by not calculating after-tax interest expense and FCFF as part of the response to this question and not going out to Year 6. We did it here for comprehensiveness in creating the table.

This question tested from Session 12, Reading 47, LOS k

Part 4)

If the growth rate of FCFF were 7 percent beginning in year 6 rather than 5 percent, how much would that add to the value that Bradshaw should be willing to pay for

A) $24.44.

B) $12.69.

C) $9.82.

D) $110.00.

The correct answer was C) $9.82.

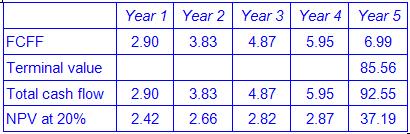

We can calculate the terminal value of the firm in Year 5 using the data from the table we created before:

Terminal Value in Year 5 = FCFF in Year 6 / (r - g)

Terminal Value in Year 5 = $7.70 / (0.14 – 0.05)

Terminal Value in Year 5 = $7.70 / 0.09

Terminal Value in Year 5 = $7.70 / 0.09

Terminal Value in Year 5 = $85.56

If we change the growth rate to 7%, we get:

Terminal Value in Year 5 = $7.70 / (0.14 – 0.07)

Terminal Value in Year 5 = $7.70 / 0.07

Terminal Value in Year 5 = $110.00

Note that we discount the terminal value by the stable growth WACC of 14%, not the rapid growth WACC of 20%.

An increase in the growth rate of the stable growth phase would add an increment of ($110.00 − $85.56) = $24.44 per share. Discounting that back to the present at the rapid growth WACC of 20% gives us ($24.44 / (1.20)5) = 9.82 per share additional value to the firm.

This question tested from Session 12, Reading 47, LOS k

Part 5)

Regarding the statements made by Bradshaw and Jimenez about the per share value of Flores Media:

A) Bradshaw’s statement is correct; Jimenez’s statement is correct.

B) Bradshaw’s statement is incorrect; Jimenez’s statement is correct.

C) Bradshaw’s statement is correct; Jimenez’s statement is incorrect.

D) Bradshaw’s statement is incorrect; Jimenez’s statement is incorrect.

The correct answer was B) Bradshaw’s statement is incorrect; Jimenez’s statement is correct.

We first calculate firm value:

Firm value = $2.42 + $2.66 + $2.82 + $2.87 + $37.19 = $47.96 per share. Jimenez’s statement is correct.

Equity value = Firm value − debt value

Equity value = $47.96 − $25.00

Equity value = $22.96 per share

A fair price for Jimenez's stake would be $22.96 × 5.2 million shares = $119,392,000. Bradshaw’s statement is incorrect.

Note that we do not calculate the value of Jimenez’s interest in Flores Media using FCFE because Jimenez has a controlling interest in the firm.

This question tested from Session 12, Reading 47, LOS k

Part 6)

If Jimenez and Bradshaw agreed to calculate the terminal value of the Flores Media using the median industry forward P/E of 12 instead of a discounted cash flow method, what impact would that have on the price that Bradshaw should be willing to pay for Flores?

A) A decrease of $22.08.

B) An increase of $7.42.

C) An increase of $22.08.

D) An increase of $8.87.

The correct answer was D) An increase of $8.87.

Since the P/E is a forward P/E, we apply it to EPS in Year 6 to get a terminal value of (12 × $8.97) = $107.64 per share. That’s ($107.64 − $85.56) = $22.08 more than the terminal value using a discounted cash flow analysis. Discounting that back to the present we get ($22.08 / (1.20)5) = $8.87 more per share.

This question tested from Session 12, Reading 47, LOS k

thx

Thank you for sharing

thanks!

THANKS

duoxie

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |