51、Assume U.S. GAAP (generally accepted accounting principles) applies unless otherwise noted.

An analyst gathered the following annual information ($ millions) about a company that pays no dividends and has no debt:

Net income | 45.8 |

Depreciation | 18.2 |

Loss on sale of equipment | 1.6 |

Decrease in accounts receivable | 4.2 |

Increase in inventories | 3.4 |

Increase in accounts payable | 2.5 |

Capital expenditures | 7.3 |

Proceeds from sale of stock | 8.5 |

The company's annual free cash flow to equity ($ millions) is closest to:

Select exactly 1 answer(s) from the following:

A. 53.1.

B. 58.4.

C. 61.6.

D. 64.0.

52、Assume U.S. GAAP (generally accepted accounting principles) applies unless otherwise noted.

Which of the following statements best describes the level of accuracy provided by a standard audit report?

Select exactly 1 answer(s) from the following:

A. There is full assurance that the financial statements are fairly presented.

B. There is reasonable assurance that the financial statements contain no errors.

C. There is full assurance that the financial statements are free of material errors.

D. There is reasonable assurance that the financial statements are fairly presented.

53、Assume U.S. GAAP (generally accepted accounting principles) applies unless otherwise noted.

Making any necessary adjustments to the financial statements to facilitate comparison with respect to accounting choices is done in which step of the financial statement analysis framework?

Select exactly 1 answer(s) from the following:

A. Collect data

B. Process data

C. Analyze/interpret the processed data

D. Develop and communicate conclusions

54、Assume U.S. GAAP (generally accepted accounting principles) applies unless otherwise noted.

During 2007 Nagano Incorporated, a manufacturing company, reported the following items on their income statement:

Loss on disposal of fixed assets | $50,000 |

Interest expense | $62,500 |

The correct classification of each of these items on the income statement would be as a(n):

| Loss on disposal | Interest expense |

A. | operating item | operating item |

B. | operating item | nonoperating item |

C. | nonoperating item | operating item |

D. | nonoperating item | nonoperating item |

Select exactly 1 answer(s) from the following:

A. Answer A.

B. Answer B.

C. Answer C.

D. Answer D.

55、Assume U.S. GAAP (generally accepted accounting principles) applies unless otherwise noted.

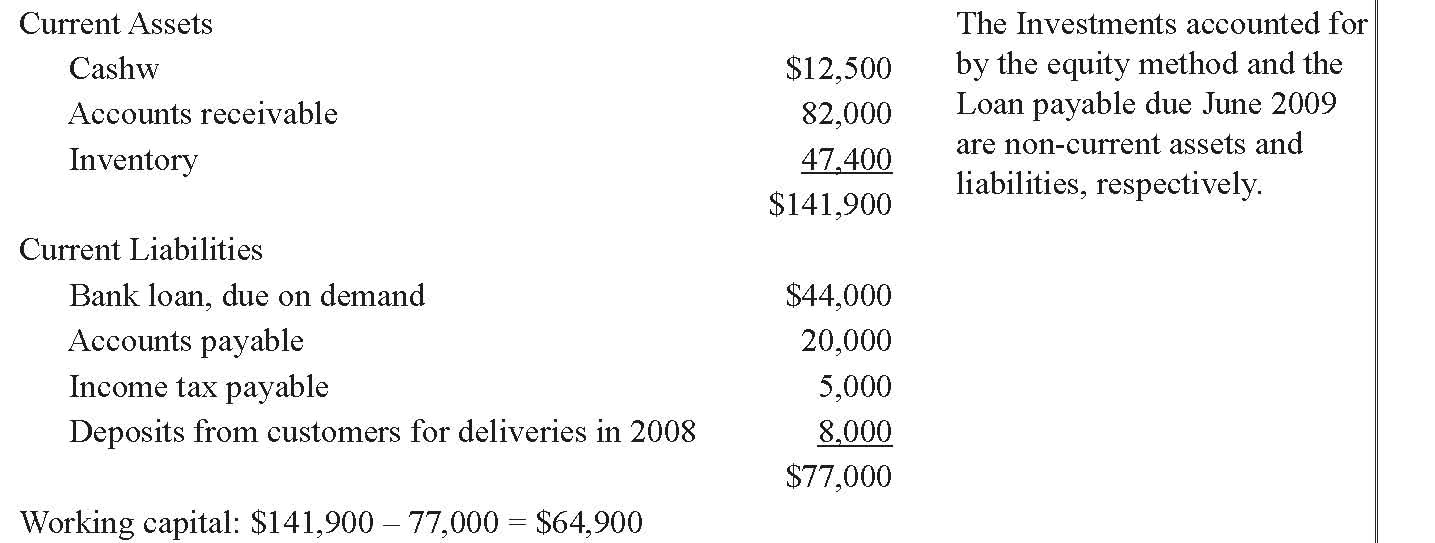

The following information was available from the accounting records of a company as at December 31, 2007:

Accounts payable | $20,000 |

Accounts receivable | 82,000 |

Bank loan, due on demand | 44,000 |

Cash | 12,500 |

Income taxes payable | 5,000 |

Inventory | 47,400 |

Investments accounted for by the equity method | 112,000 |

Loan payable, due June 30, 2009 | 50,000 |

Deposits from customers for deliveries in 2008 | 8,000 |

The working capital for the company is closest to:

Select exactly 1 answer(s) from the following:

A. $14,900.

B. $64,900.

C. $72,900.

D. $176,900.

51 Correct answer is C

“Understanding the Cash Flow Statement,” Thomas R. Robinson, Hennie van Greuning, Elaine Henry, and Michael A. Broihahn

2008 Modular Level I, Vol. 3, pp. 275-278, 287-288

Study Session 8-34-i

explain and calculate free cash flow to the firm, free cash flow to equity, and other cash flow ratios

Free cash flow to equity in a company without any debt is equal to cash flow from operations (CFO) less capital expenditures. CFO = net income + depreciation + loss on sale of equipment + decrease in accounts receivable - increase in inventories + increase in accounts payable. (The loss on sale of equipment is added back when calculating CFO. It would have been deducted in the calculation of net income but the loss is not the cash impact of the transaction (the proceeds received, if any, would be the cash effect) and cash flows related to equipment transactions are investing activities, not operating activities.)

CFO = 45.8 + 18.2 + 1.6 + 4.2 - 3.4 + 2.5 = $68.9 million

$68.9 - $7.3 = $61.6 million free cash flow to equity.

52 Correct answer is D

“Financial Statement Analysis: An Introduction,” Thomas R. Robinson, Jan Hennie van Greuning, Elaine Henry, and Michael A. Broihahn

2008 Modular Level I, Vol. 3, p. 21

Study Session 7-29-d

discuss the objective of audits of financial statements, the types of audit reports, and the importance of effective internal controls

Audits provide reasonable assurance that the financial statements are fairly presented, meaning that there is a high degree of probability that they are free of material error, fraud or illegal acts.

53 Correct answer is B

“Financial Statement Analysis: An Introduction,” Thomas R. Robinson, Jan Hennie van Greuning, Elaine Henry, and Michael A. Broihahn

2008 Modular Level I, Vol. 3, pp. 26-30

Study Session 7-29-f

describe the steps in the financial statement analysis framework

Making any adjustments is part of the processing data step. Commonly used data bases (part of the collection phase) do not make adjustments for differences in accounting choices.

54 Correct answer is B

“Understanding the Income Statement,” Thomas R. Robinson, Jan Hennie van Greuning, Elaine Henry, and Michael A. Broihahn

2008 Modular Level I, Vol. 3, pp. 169-171

Study Session 8-32-f

distinguish between the operating and nonoperating components of the income statement

The loss on the disposal of fixed assets is an unusual or infrequent item but it is still part of normal operating activities. The interest expense is the result of financing activities and would be classified as a nonoperating expense by nonfinancial service companies.

55 Correct answer is B

“Understanding the Balance Sheet,” Thomas R. Robinson, Jan Hennie van Greuning, Elaine Henry, and Michael A. Broihahn

2008 Modular Level I, Vol. 3, pp. 201-207

Study Session 8-33-a, d

illustrate and interpret the components of the assets, liabilities, and equity sections of the balance sheet, and discuss the uses of the balance sheet in financial analysis;

compare and contrast current and noncurrent assets and liabilities

Working capital = current assets - current liabilities.

fere

fefd

jghg

谢

顶!!!!!!!!!!!

好的

3x

55的答案应该为D,因为loss on disposal of fixed assets 是non operatng items

thanks

thanks

rt

| 欢迎光临 CFA论坛 (http://forum.theanalystspace.com/) | Powered by Discuz! 7.2 |