|

The correct answer is D

First calculate the probability of a down move as: pd = 1 – pu = 1 – 0.6074 = 0.3926

Next calculate the terminal values of the option at expiration for each node of the tree:

Suu = $30 × 1.10 × 1.10 = $36.30, Puu = $0

Sud = $30 × 1.10 × 0.90 = $29.70, Pud = $2.80

Sdu = $30 × 0.9 × 1.10 = $29.70, Pdu = $2.80

Sdd = $30 × 0.9 × 0.9 = $24.30, Puu = $8.20

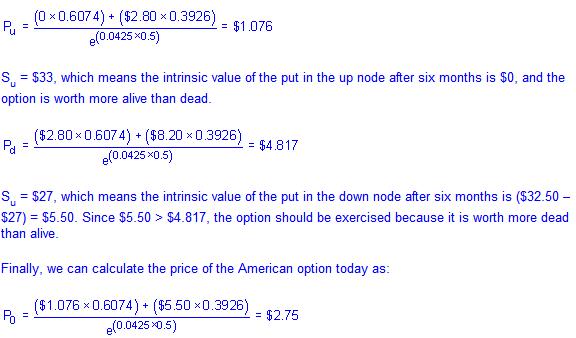

Since this is an American option, we need to compare the discounted present value of the option to its intrinsic value after the end of the first 6-month period to see if the option is worth more dead than alive.

|